ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.

Study Scope

This report, published with contributions from Propulsion Québec (the cluster for electric and smart transportation), describers the current and future labour demand and the skills needed by Quebec’s EV (electric vehicle) industry.

It includes workforce development solutions, training, reskilling, and upskilling that will help fill the demand for new roles in this growing sector.

Study Context

Quebec has emerged as a significant player in the Canadian electric vehicle (EV) industry, with expanding ability to compete internationally.

In alignment with the Quebec government’s 2030 Plan for a Green Economy, the province has made electrification of the transportation sector a major priority:

- Quebec’s strength in EV commercial vehicle market encompasses garbage trucks, school buses, heavy equipment, and utility vehicles

- Growing demand for technical roles is anticipated—mechanical and electrical engineers, full stack developers, embedded software developers, machine learning specialists, and several emerging roles

Quebec’s EV leaders are optimistic about the overall labour market outlook, however, the development of workforce upskilling or reskilling programs could enhance Quebec’s ability to effectively respond to evolving market demands and to maintain the transport sector’s competitive edge.

Study Findings

EV Industry in Canada and Quebec

The growth of Canada’s EV industry is a response to climate change. Milestones in the effort to mitigate climate change include Canada’s signing of the Kyoto Protocol in 1997 and recent commitments to achieve a net-zero economy by 2050.

The transport sector is an area of key focus because it is the second largest source of carbon emissions in Canada:

- Transportation produced 186 megatonnes of CO2e in 2019 (~25% of Canada’s total emissions)

- The federal government has invested over $1 billion since 2015 to decarbonize this sector, largely focused on EVs and charging infrastructure

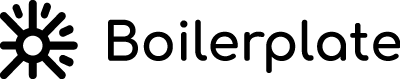

Despite this investment, EV sales remain low:

- In Q1 2021, only 3.34% of total vehicle sales were EVs

- British Columbia bought 9.48% of the country’s total EV sales

- Quebec bought 5.51% (in part due to existing provincial incentives)

Limited charging infrastructure, reduced battery performance in cold climates, and the high cost of EVs currently hinder stronger adoption.

Defining Electric Vehicles and Their Supply Chain

EVs (also referred to as BEVs—Battery Electric Vehicles), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs) all use electric motors but differ in how the motors are powered.

- PHEVs receive their power from an electrical outlet as well as from a combustion generator that feeds an electrical motor

- FCEVs produce power for the motor by a chemical reaction between hydrogen and oxygen

Between 2016 to 2020, hybrid and plug-in hybrid electric vehicles accounted for a larger share of new vehicle registrations in Canada.

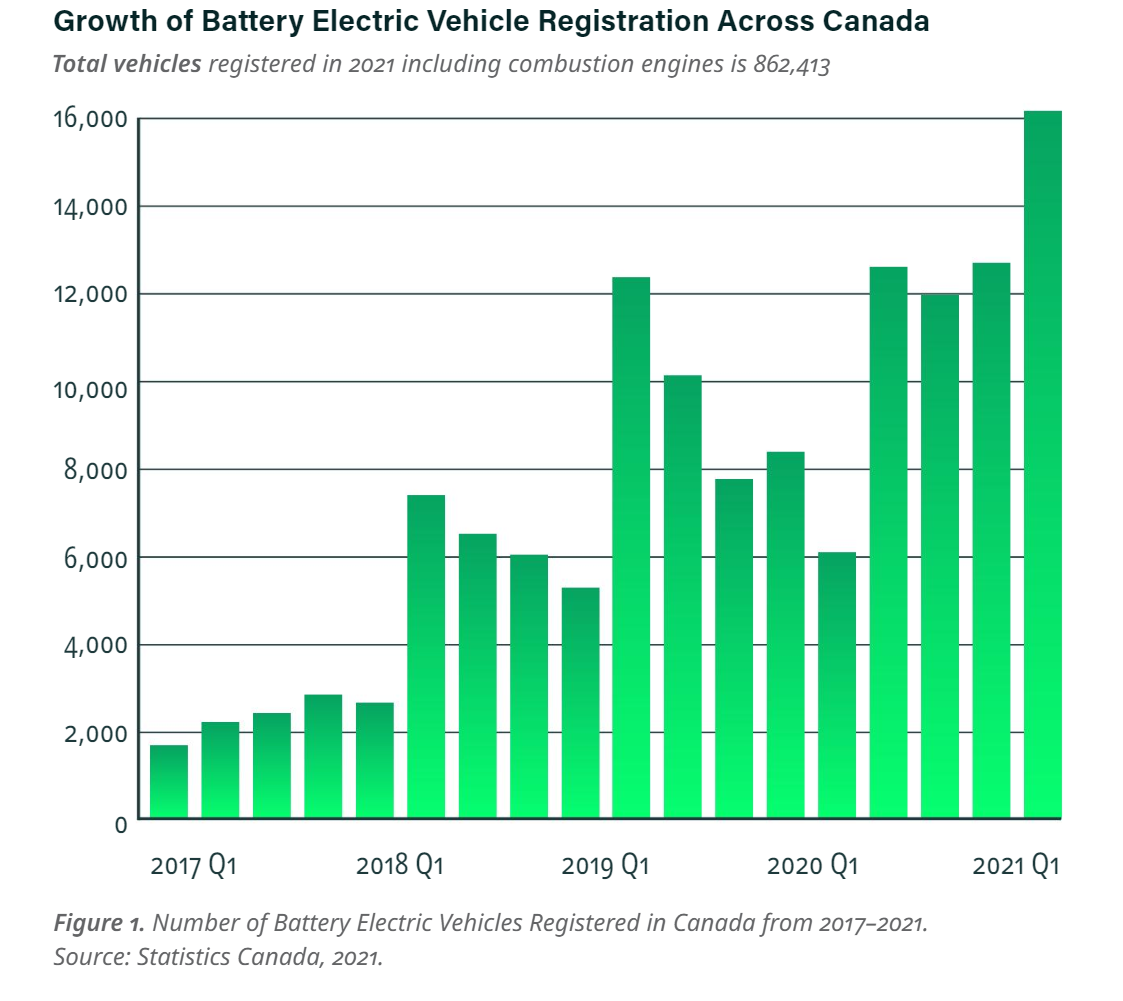

This paper focuses on the BEV value chain (the most prevalent in the Quebec market) and the following activities in the BEV value chain:

- Design and Engineering Services

- Tier 1 Suppliers (e.g., electrical motors, batteries, chassis systems)

- Tier 2 Suppliers (e.g., manufacturers of electrical cables, circuit boards, metal manufacturing)

- Tier 3 Suppliers (e.g., plastic producers, raw material processors, and other suppliers of materials needed to manufacturer Tier 2 products)

- Artificial intelligence (AI) and Software developers (includes mobility services, embedded software, drive assist/self-driving software and others)

- Original Equipment Manufacturers

- Wholesale distribution, retail sales and maintenance/repair services

- Recycling services (e.g., Battery and electronic recyclers)

Canada and the Global EV Industry

Canada is the eighth largest producer of EVs in the world, with a similar industry size as France, Japan, South Korea, and Sweden.

Canada is also the only country in the western hemisphere that has all the required critical minerals for manufacturing EVs.

Canada’s automotive industry hub is based in Ontario and has the largest concentration of automotive assembly plants and R&D facilities in North America, and includes:

- Five global OEMs (Fiat Chrysler, Ford, General Motors, Honda, and Toyota)

- Assembly of more than two million vehicles each

- Part of a larger system of 700+ parts suppliers, including major Canadian companies such as Magna (Aurora), Linamar (Guelph), Multimatic (Markham) and Martinrea (Vaughan).

The auto industry is Canada’s second largest export, contributing $74.2 billion of GDP in 2020.

Car manufacturer commitments to electrification include:

- Ford, 40% of all sales are expected to be EVs y 2030

- GM, 50% of assembly plants will be dedicated to producing EVs by 2030

These commitments signal future investments, further supported by government funding to accelerate change.

Quebec’s Electric Vehicle Industry

The Quebec automotive industry is the second largest in Canada, consisting of manufacturers of automotive parts, recreational vehicles, heavy-duty vehicles, buses, and specialty vehicles.

Quebec is an established global leader in the transport equipment industry:

- Employs over 32,000 people

- In over 620 companies

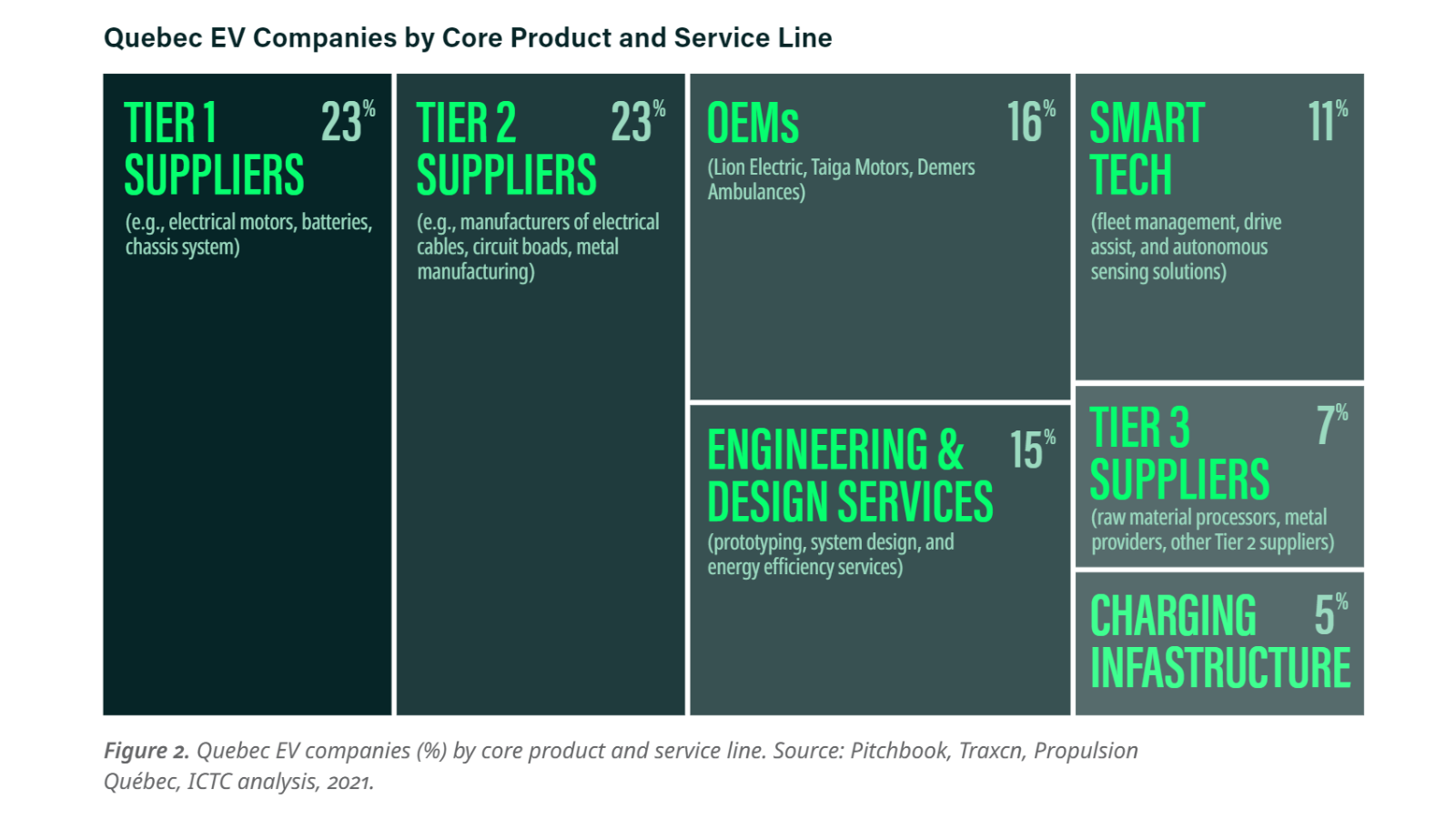

Company size is one indicator of overall maturity of a business. A predominance of smaller companies suggests an industry in early stages of development, which typifies Quebec’s situation.

Example of a Quebec EV Company:

Lion Electric (Saint-Jérôme, Quebec). Electric bus manufacturer. Also developed all-electric Class 6 and Class 8 commercial urban trucks.

- In 2020, Lion Electric announced a collaboration with vehicle-to-grid technology company Nuvve Corporation (demonstrating feasibility of vehicle-to-grid opportunities in California and New York)

- In 2021, Amazon and Lion Electric entered into an agreement worth $1.1 billion, in which Amazon agreed to purchase up to 2,500 buses of the Lion 6 and Lion 8 models by 2025.

- Lion Electric will invest approximately $185 million to build a battery production plant in Mirabel, Quebec

- The provincial and federal governments are supporting this investment by providing $100 million, and the plant is expected to produce 135 direct jobs and hundreds of indirect jobs. (The plant intends to produce five gigawatt hours of battery storage per year and enough batteries for 14,000 medium and heavy-duty vehicles)

Provincial Strengths: Quebec’s Battery Supply Chain, Sustainable Energy

The growing adoption of EVs presents a major opportunity for Quebec to secure a key role in the EV battery manufacturing supply chain by leveraging its provincial strengths in raw materials, research expertise, and affordable clean energy.

Currently, most EV batteries are produced by suppliers in Asia: 80% of the world’s batteries are produced in Japan, South Korea, and China. China alone is responsible for the majority of global battery material processing and cathode production, giving it significant influence over pricing and supply chain flows. Consequently, many countries are exploring options for diversifying battery sourcing.

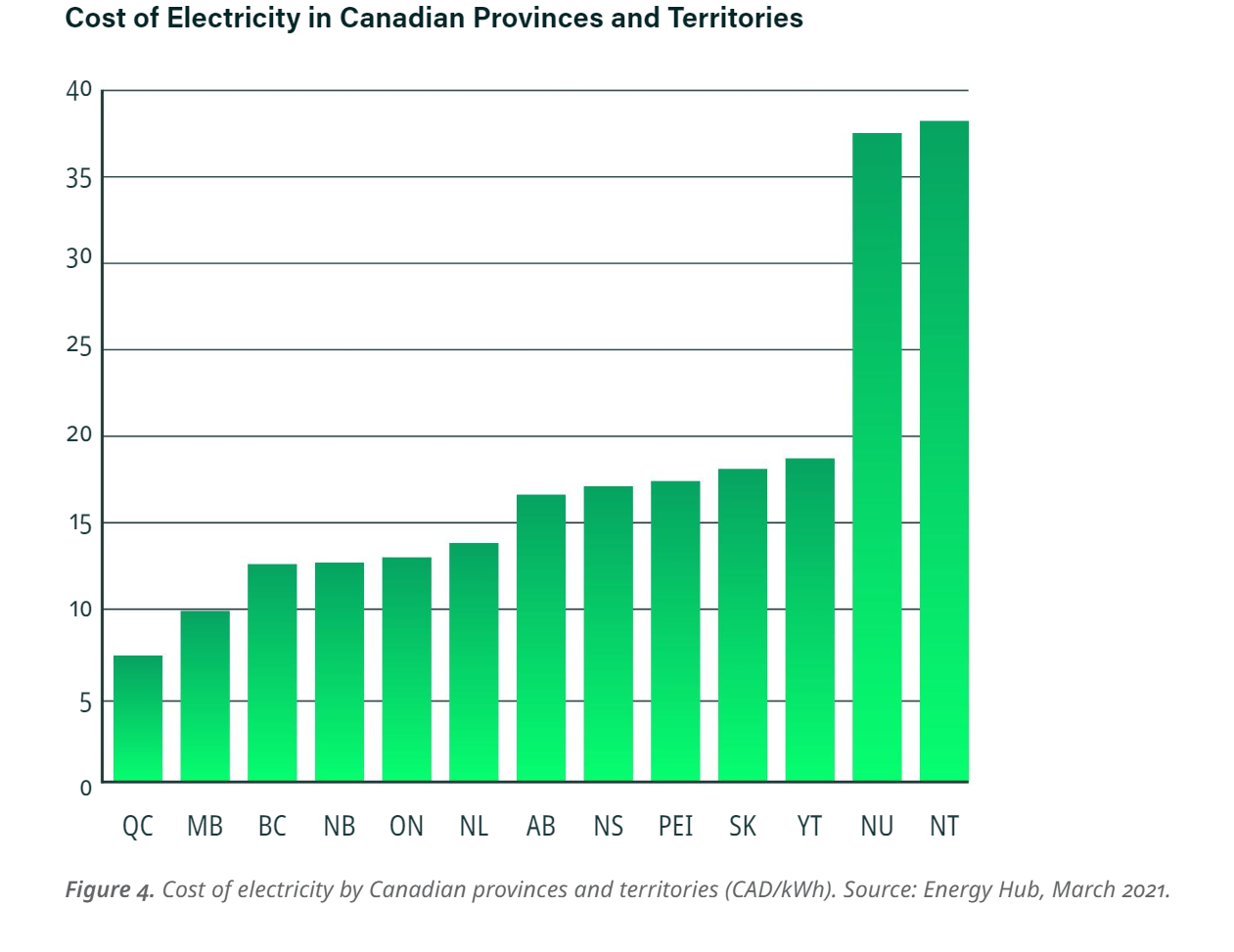

A green future involving EV sales and EV supply chain infrastructure requires affordable environmentally friendly energy. Quebec’s legacy hydroelectricity assets provide it the most affordable electricity in Canada, at 7.3 ¢/kWh in March 2021.

- Affordable electricity is a major benefit for battery manufacturing and other industries that are energy intensive

- Hydro-Québec, the main power provider in the province, also has critical battery expertise through facilities such as the Centre of Excellence in Transportation Electrification and Energy Storage (focused on innovation in battery materials, material processing, and energy storage solutions)

- Stromcore Energy Inc, an assembler of lithium-ion batteries for forklifts, has announced preliminary plans to build Canada’s first large-scale lithium-ion battery cell factory in Quebec

In planning for the emerging green economy, the province has launched two initiatives: Quebec’s strategy for developing a battery industry and the Quebec Plan for the Development of Critical and Strategic Minerals (the government is determined “to make Quebec a preferred haven for critical and strategic minerals value enhancement, including localized cleantech development and manufacturing.”

Impacts of EV Shift on Labour

The shift to EV from internal combustion engine (ICE)-powered vehicles will yield mixed employment impacts, including job losses and gains.

- Job losses are expected in oil and gas production, design, manufacturing, marketing, accounting, repair and sales, and retail sale of automotive fuel

- Germany estimates that electrifying the automotive industry will result in a drop in employment between 11% and 35%

- In the U.S., Ford Motor Company similarly acknowledged that product simplification in EVs can lead to a 50% reduction in capital investment and a 30% reduction in labour hours per unit compared to standard ICE production

- Job gains, however, are expected in electricity generation and management, battery manufacturing, electrical parts and machinery, and through the creation of EV charging infrastructure and data management and analysis

- Rapid advances in robotics and novel applications of software will further impact employment

About 65% of jobs in the auto industry are based on tasks that can be largely automated over the next decade. Industrial robots reduce the need for human labour in various manufacturing tasks, including quality inspection, machine tending, material removal, and parts transfer.

Job gains are expected in technology-centric roles such as electrical, mechanical, and software engineers.

Employment Impacts

Despite negative employment impacts on the traditional ICE industry, experts expect overall job creation to far outweighs job losses in the transition to EV for Quebec’s automotive industry.

Changing Roles and In-Demand Skills

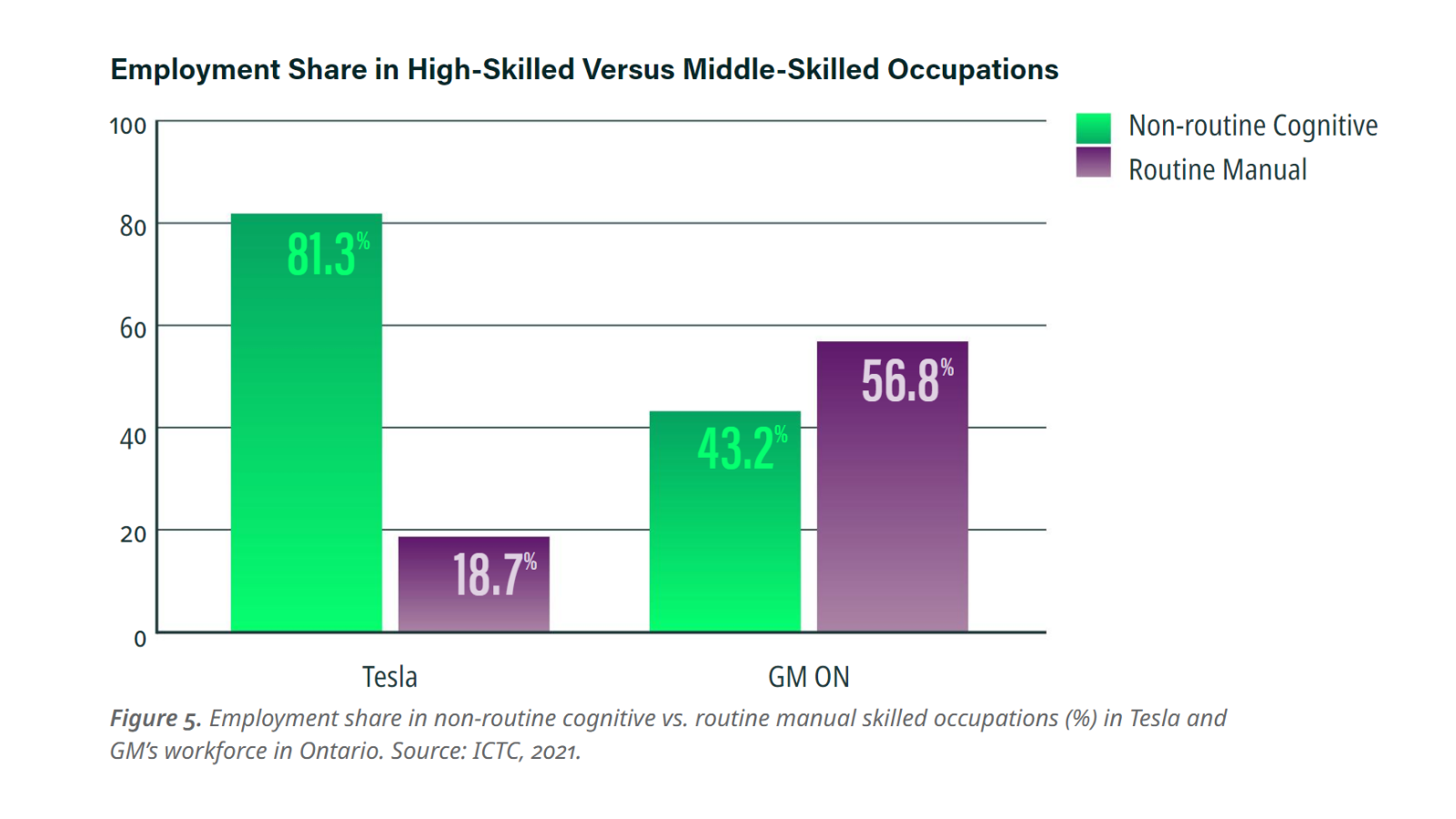

The shift from EV production is likely to increase the demand for high-skilled workers.

- Demand for manual workers tends to decline

- Demand for abstract professions (e.g., engineers, designers, etc.) tends to increase

More high-skilled (i.e., non-routine cognitive) worker will be need versus middle-skilled (i.e., routine manual).

Quebec’s EV Industry Employment Demand

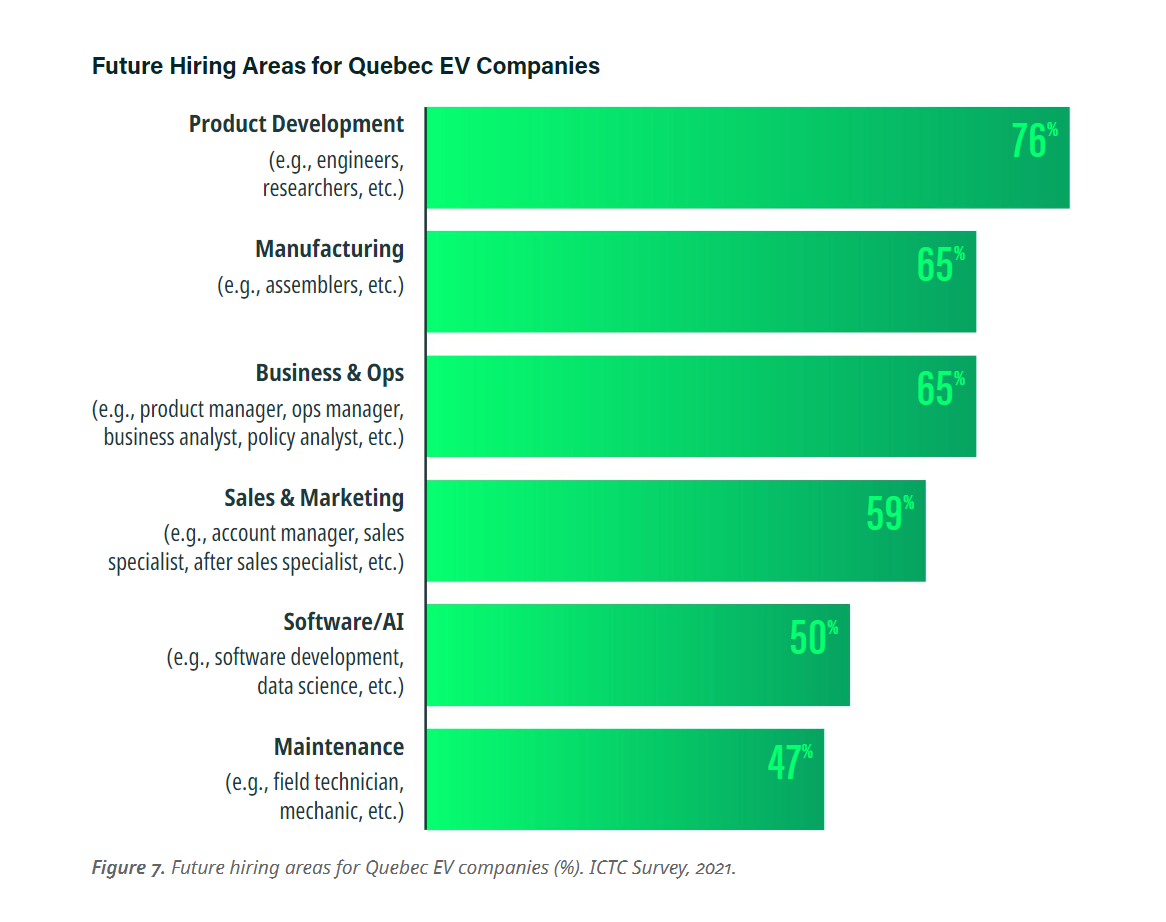

ICTC survey respondents note predominantly positive workforce impacts in these areas: general engineers, software engineers, software designers, and electrical engineers.

Recruiting Skilled Talent to Quebec’s EV Industry In-Demand Roles and Skills

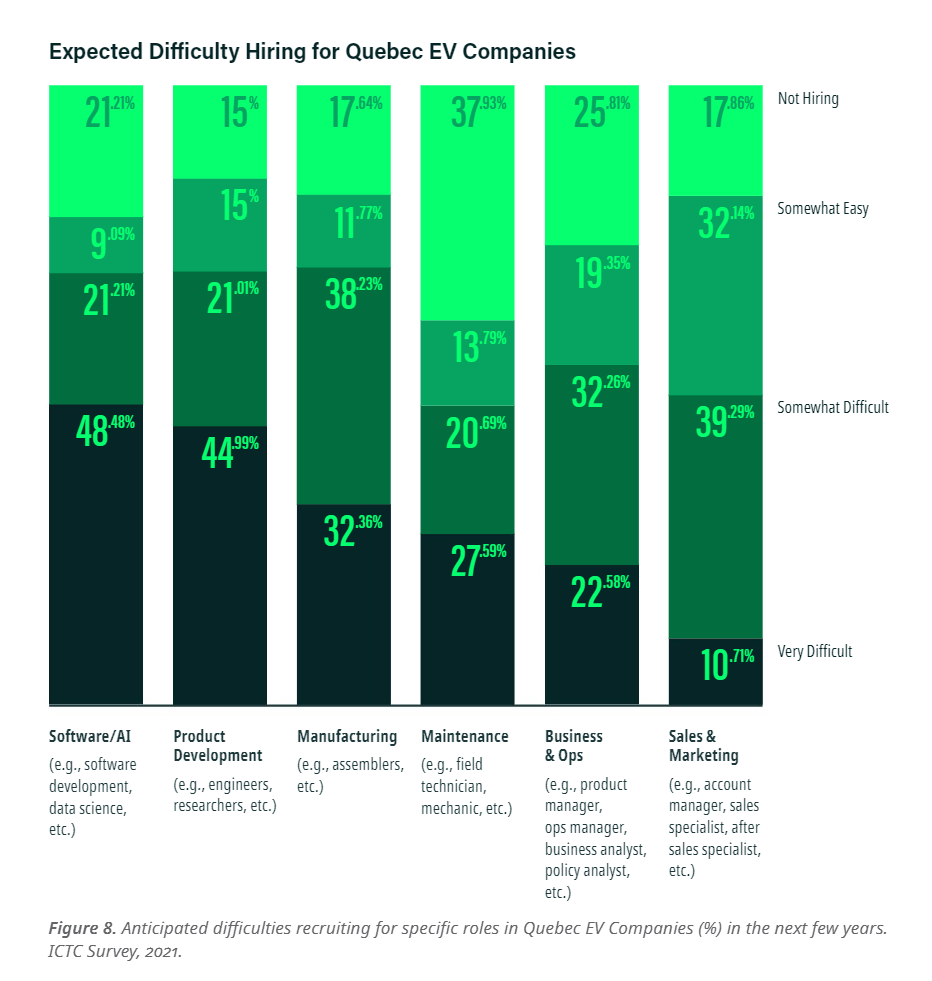

ICTC’s survey found that most EV companies find it “very difficult” or “somewhat difficult” to hire skilled talent for in-demand roles.

Emerging Jobs in Advanced EV Ecosystems

Longer-term in-demand skills per category and the occupations most often associated with the skills are presented in the report on pages 31—37 in the report, across the following six areas: software, data, industrial, service, process, and product.

Role of Public Policy in Quebec’s EV Labour Market

Public policy in two forms can facilitate the shift to EVs and its requirements for skill-biased technologies favouring higher skilled workers (including roles that require a STEM education, expertise in project management, business development and sales, etc.):

1. Public policy that directly supports the development of a domestic EV supply chain, including a complete battery value chain

- Governments could consider R&D investments to rapidly accelerate the deployment of a variety of EV-adjacent industries, including the sourcing and recycling of critical minerals, the development of alternative battery technologies, and end-of-life battery management

2. Public policy to prepare for the change in skill requirements triggered by the electrification of the auto industry

- A crucial role for public policy is to transition of workers whose jobs might be displaced, into alternative and emerging roles

- Partnerships between the public and private sector and employment service providers can improve access to existing training opportunities and inform new curricula development with industry input

Quebec Policy

Quebec expects to reach carbon neutrality by 2050 and electrification of the transportation sector will be a key element of this target (transport contributes43% of the province’s carbon footprint).

- Since 2012, the Quebec government has provided over $576 million to support the sale of electric and plug-in hybrid vehicles through its Roulez vert program

- Quebec’s 2030 Climate Plan for a Green Economy focuses on the electrification of buildings, transportation, and industrial activities, and the expansion of renewable energy sources, and includes:

- $3.6 billion in the transportation sector

- $401 million to support new businesses in strategic and innovative fields such as the development of an industrial ecosystem for electric vehicles, charging infrastructure, and batteries

- Notably, a substantial and unprecedented investment of $15.8 billion will be directed to public transportation via the 2020–2030 Quebec Infrastructure Plan.

As a final consideration, the Canadian government’s Just Transition discussion paper sets out comprehensive recommendations for how stakeholders can work together to enact a green industrial revolution toward net zero and meet the challenges of the needed workforce transition.

ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.