ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.

Study Scope

Searching for Hidden Talent: Experience and Expertise in New Brunswick’s Cybersecurity Community explores the cybersecurity ecosystem in New Brunswick — a significant centre of cybersecurity activity in Canada — through the lens of cybersecurity labour demand and supply.

Searching for Hidden Talent also explores:

- trends in cybersecurity employment

- the most needed skillsets

- the challenges facing New Brunswick’s cybersecurity ecosystem

- opportunities for bridging the cybersecurity labour gap

Study Context

Cybersecurity talent is in short supply in the global digital economy. By 2022, a worldwide cybersecurity labour shortage of 1.8 million workers is expected, with a corresponding North American shortfall of 265,000 people.

The demand for cybersecurity talent in New Brunswick is confirmed by the study’s key informant interviews and job postings:

- 67% of the study respondents expected to expand their cybersecurity workforce in the next year

- New Brunswick has a high volume of cybersecurity job openings compared to its population

General Study Findings

The cybersecurity industry in New Brunswick continues to gain international recognition as a well-networked and collaborative ecosystem, which is expected to continue its expansion.

The province’s cybersecurity ecosystem offers the following advantages and disadvantages:

ADVANTAGES

- Public sector investment

- Large industry player

- High quality of life

DISADVANTAGES

- Remoteness

- High unemployment

In the study, industry experts praised New Brunswick’s dedicated organizations that play a hands-on role in workforce development:

- Provincial colleges are receptive to industry feedback and agile in creating relevant digital tech curricula and innovative training, including internships and co-op student work placements

- Current academic efforts are graduating sufficient entry-level cybersecurity workers

- However, senior-level cybersecurity roles in the province are difficult to fill

Overall, New Brunswick outperforms many Canadian regions in important metrics such as the cybersecurity jobs-to-population ratio, workforce development, and training institutions.

Photo by James Ting on Unsplash

Detailed Findings

Collaborative Ecosystem Builds Awareness

A collaborative approach between industry, government, and academia is effective in elevating cybersecurity awareness in the province and has the potential to fill the cybersecurity talent pipeline:

- Nearly 75% of interviewees mentioned successful workforce development efforts by the government mandated agency CyberNB

- Over a 33% noted the province’s support of early education programs (such as ICTC’s CyberTitan, a program that helps attract youth to the field)

- 80% of interviewees mentioned their involvement in K-12 and post-secondary schools

- 66% contributed to cybersecurity education initiatives outside of their professional obligations

Demand

Strong Cybersecurity Talent Demand

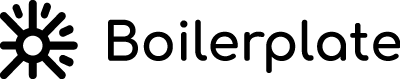

In 2018, 4,732 people worked in Cybersecurity NOCs in New Brunswick (0.6% of the province’s total population in that year).

New Brunswick’s cybersecurity unemployment rate outperforms both the wider tech (ICT) sector and employment in general:

Cybersecurity Talent by Sector and Size

Cybersecurity personnel are often IT generalist assigned responsibility for cybersecurity.

- Investment in dedicated cybersecurity personnel is more common in larger organizations

- About 30% of smaller organizations (less than 100 employees) reported having no cybersecurity personnel, compared to 7.4% of medium and large organizations (100+)

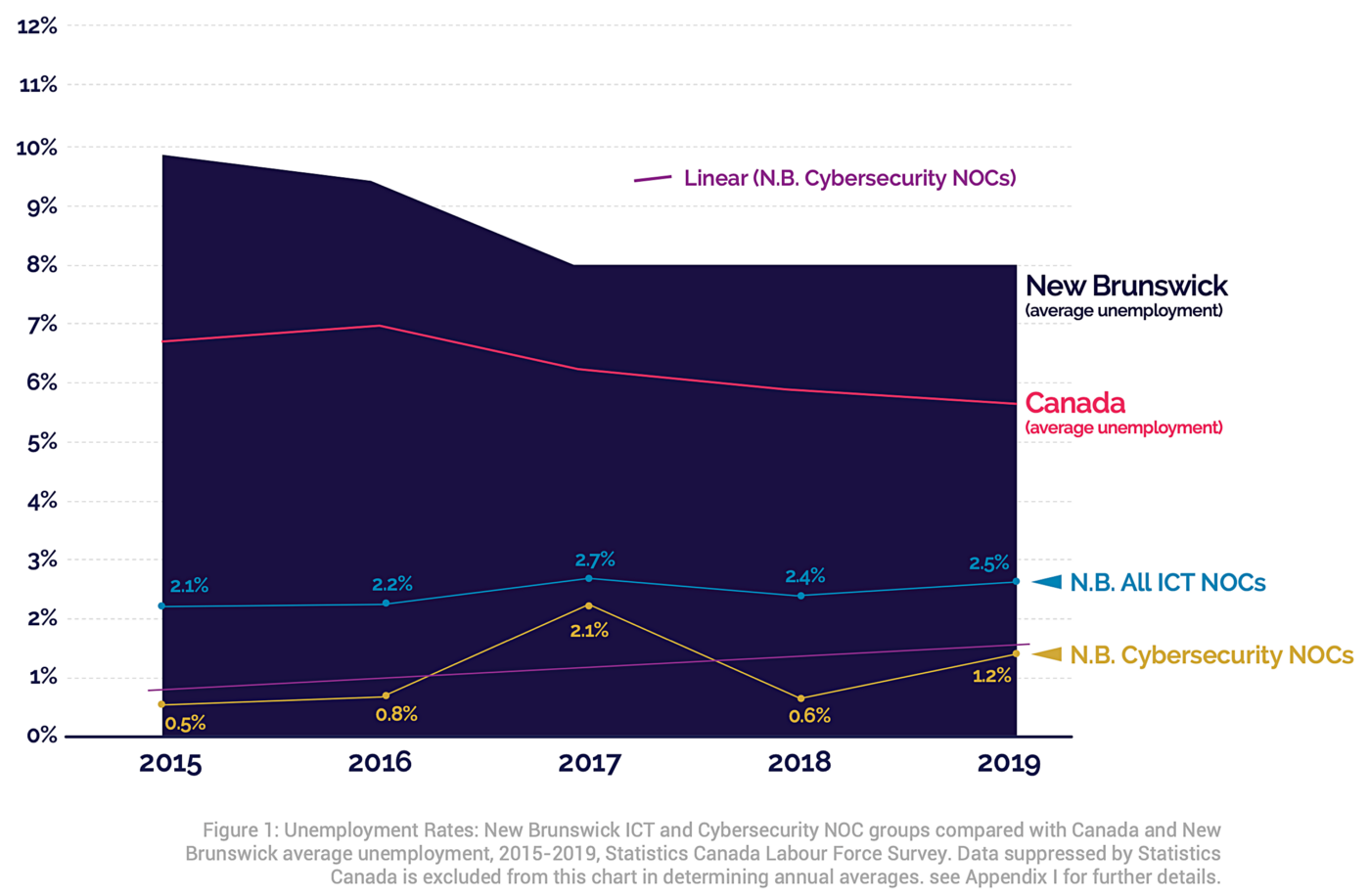

The top reasons cited in Canada for not employing cybersecurity personnel is employee-shared responsibility for cybersecurity and outsourcing:

Figure compares ICTC Cybersecurity Employer Survey (2019) and Statistics Canada Survey of Cybercrime (2017). See full report for additional details.

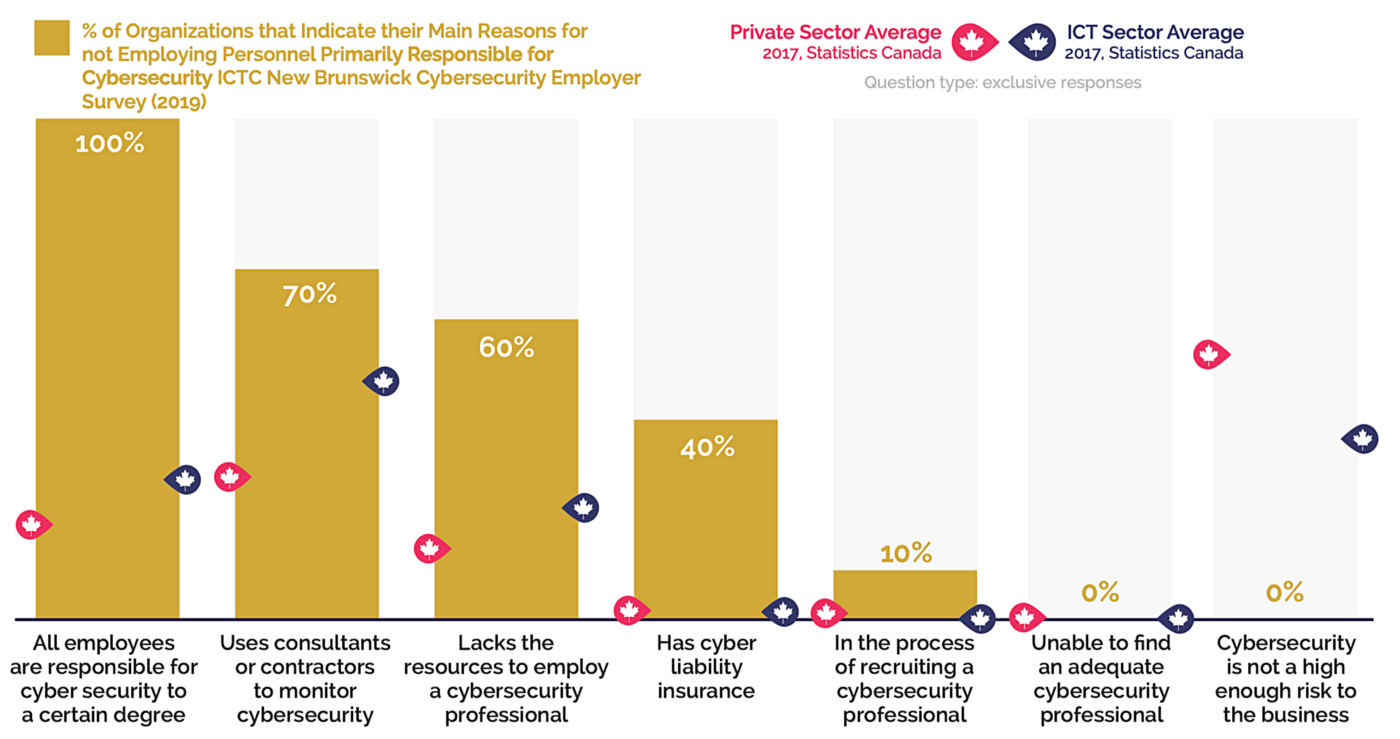

Most Likely Industry Sectors to Employ Cybersecurity personnel are finance and insurance, followed by utilities:

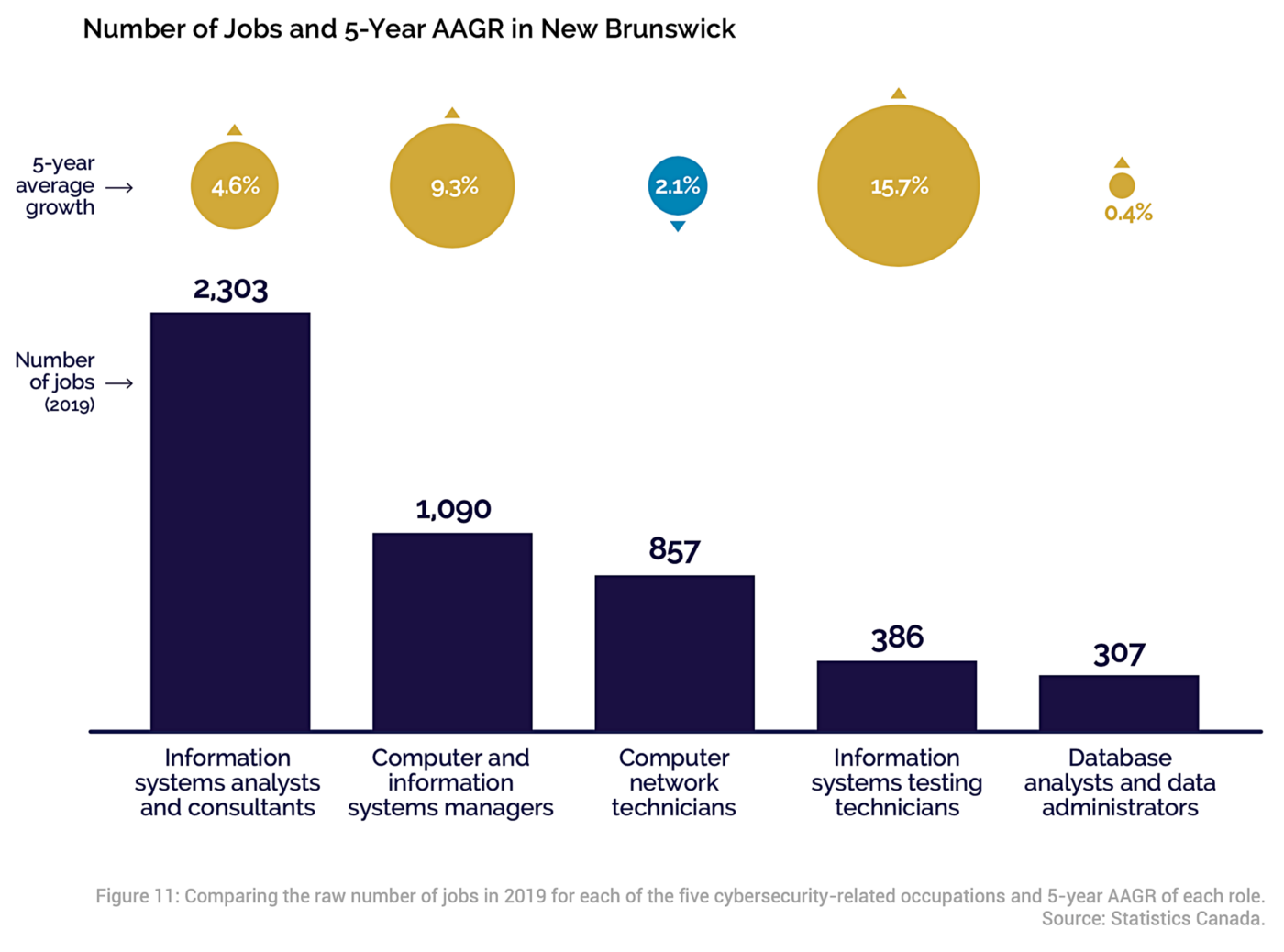

Cybersecurity Testing Technicians See Highest Demand Growth

System Analysts and Consultants represent the greatest number of Cybersecurity jobs, whereas Information Systems Testing Technicians are seeing the strongest growth rate:

Cybersecurity Skill Sets

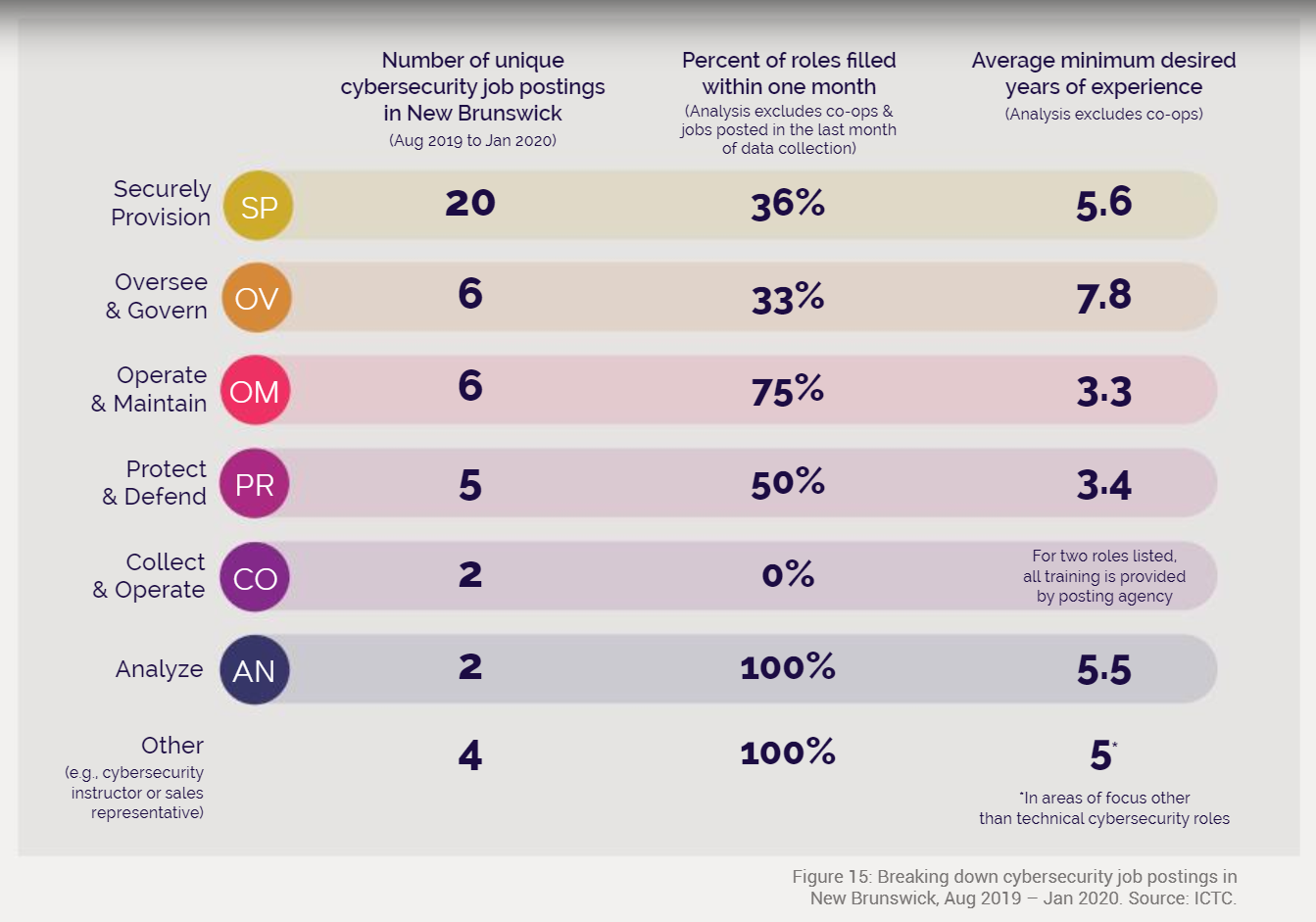

Cybersecurity roles can be grouped in various buckets: Security Provision, Operate & Maintain, Oversee & Govern, etc.

Security Provision roles are most frequently advertised in New Brunswick and show high growth rates in demand, followed by the Operate & Maintain bucket of cybersecurity roles. Secondary data suggests that senior-level roles in the Oversee & Govern category are also difficult to find.

Cybersecurity job postings in New Brunswick across categories is led by demand for experienced specialists in the Security Provisions category, which are not being readily filled:

Figure details findings from ICTC’s webscraping of various job boards in New Brunswick. Aug 2019-Jan 2020. See full report for additional details.

Skills and Cybersecurity Credentials Employers Look For

New Brunswick employers typically search for cybersecurity personnel with several years of relevant work experience. Similarly, teamwork, interpersonal skills, and adaptability/flexibility are regarded as important in the workplace.

Employers base their talent preferences on a combination of experience and academic training, whether it’s formal, informal, certification-based, or post-secondary. Some organizations favour professional certifications.

Credentials ranked by importance by surveyed New Brunswick cybersecurity employers:

Source: ICTC New Brunswick Cybersecurity Employer Survey, 2019. Scores reflect points assigned by surveyed employers.

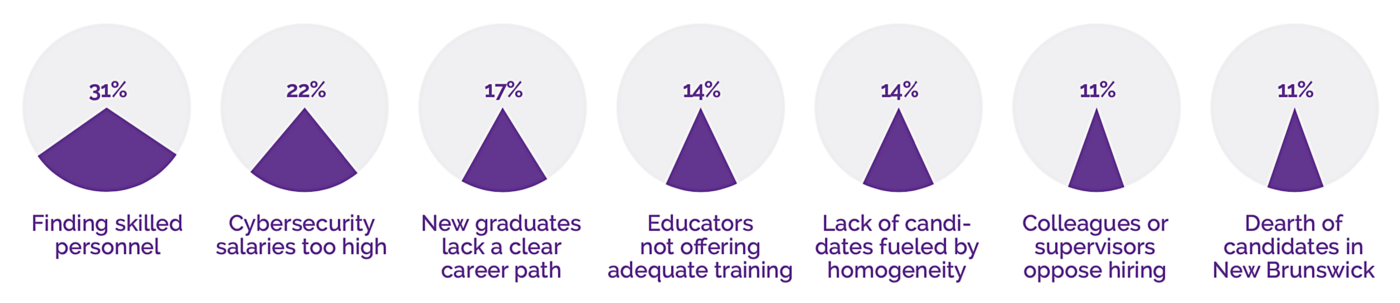

Challenges to Hiring

Senior-level cybersecurity talent is in shortest supply in New Brunswick, with lesser challenges in finding less experienced talent.

Employers identified a range of reasons for their difficulties in hiring, including skill gaps, retention, unclear career paths, salary expectations, and diversity.

Surveyed New Brunswick employer perspectives on top cybersecurity hiring challenges:

Source: ICTC New Brunswick Cybersecurity Employer Survey, 2019.

Talent Supply

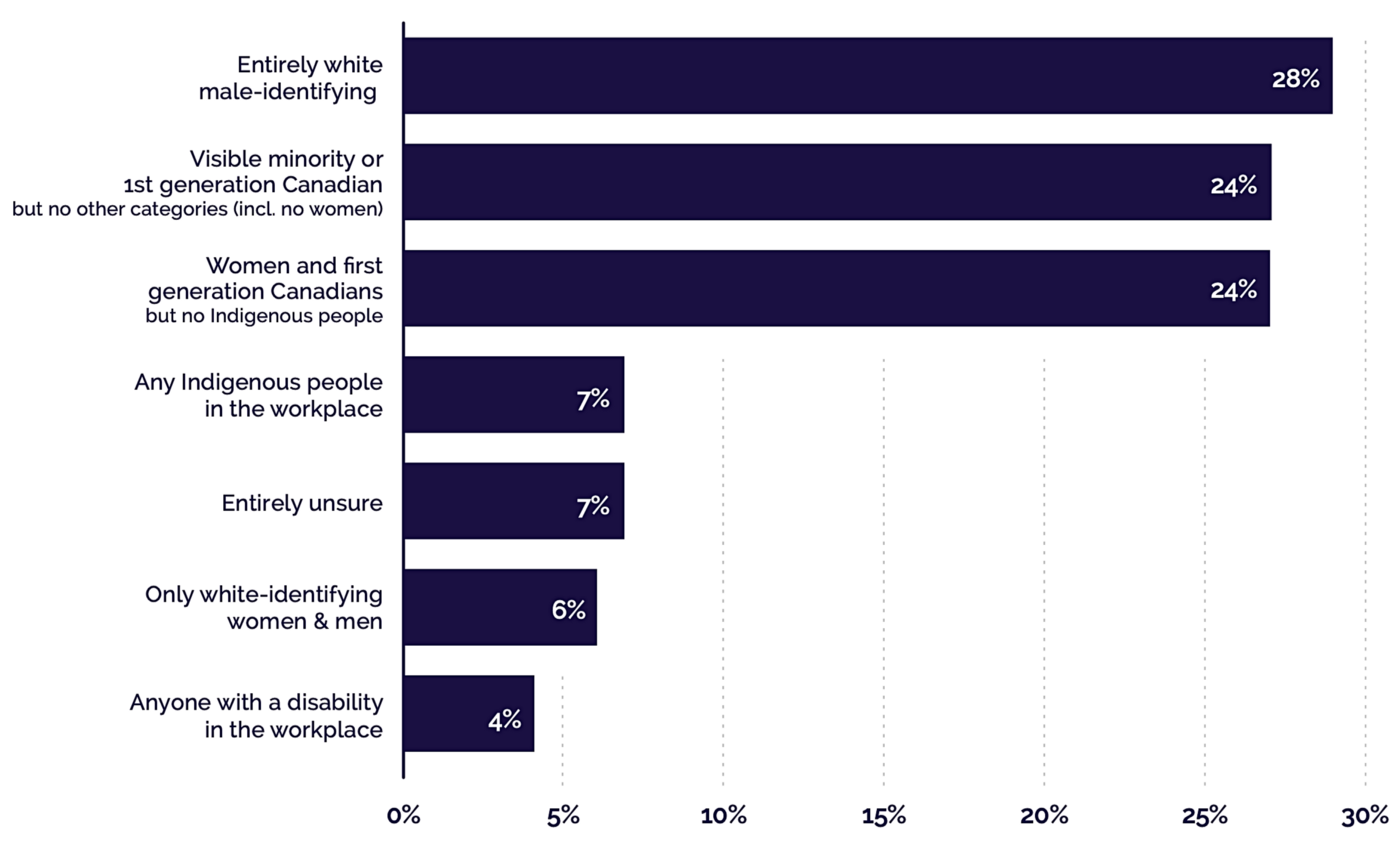

Demographics of New Brunswick’s Cybersecurity Sector

The cybersecurity sector in New Brunswick lacks diversity, as it does worldwide.

- 52% of New Brunswick’s surveyed employers report no women in their cybersecurity workforce

- Women who work in cybersecurity are paid less

- Indigenous people and newcomers/immigrant are under-represented in New Brunswick’s cybersecurity workforce

New Brunswick’s cybersecurity demographics mirror other jurisdictions:

Source: ICTC Cybersecurity Employer Survey, 2019, New Brunswick. Data reflects employer perceptions of their cybersecurity workforces.

Unique Demographics to the Province

New Brunswick’s tech sector average age is younger than that in the rest of Canada. Some 43% of the total workforce is between the ages of 45 and 64, compared with only 35% of the wider tech sector labour force.

Clear career paths for younger workers will be needed to fill higher-skilled, higher-salary roles, and they will also act as measures to retain young people in the province.

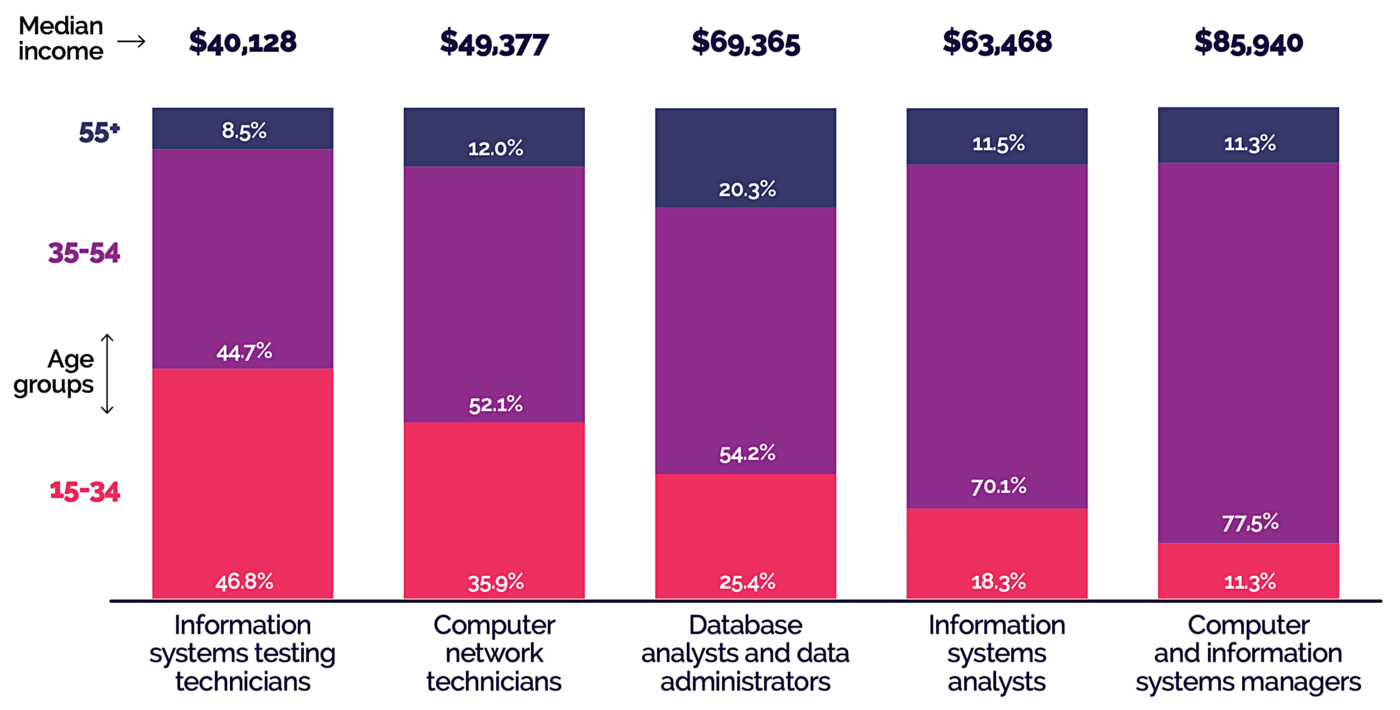

Age and Median Salary in New Brunswick Cybersecurity Employment (2015, CAD)

Data source: Government of New Brunswick, Statistics Canada, 2015. Analysis by ICTC, 2019. The five National Occupation Classifications (NOCs) represented here were identified as cybersecurity-related by ICTC.

Challenges of Efficacy

Despite New Brunswick’s collaborative initiatives for strengthening its cybersecurity talent supply pipeline, these efforts seem to have only limited positive influence:

- Employment in cybersecurity NOCs is lower now than it was five years ago

- Various data sources suggest continued growing demand for experienced cybersecurity professionals

- New graduates may not be able to fill employers’ cybersecurity needs

- Workforce development efforts may inadvertently bolster a supply of entry-level candidates to low-growth areas

Bridging the Labour Gap: Recommendations

Improve professional development and cybersecurity training for existing professionals.

- 57% of international employers (57%) indicate they are increasing staff training

Identify mid-career professionals with relevant training and transferable skills.

- Veterans Affairs Canada (VAC) estimates 25,000 skilled working-age individuals reside in New Brunswick and have experience that fits within the scope of cybersecurity industry needs

- US tech companies are already connecting with the military for skilled cybersecurity roles

Formalize well-defined cybersecurity career advancement paths for new graduates.

- Increase the number and duration of co-op or work-integrated learning opportunities

Address underrepresentation and uneven advancement opportunities for women and minorities.

- Greater diversity and equal opportunity in the cybersecurity sector would increase the pool of potential hires

Conduct further inquiry into clear pathways for international hires.

- Several interviewed employers noted difficulties and wait times in immigration processes

Improve the loyalty of young workers who are most likely to leave their jobs.

- Offer workplace training, role diversity, payment for certification (footed by the company), and support for remote/flexible working

Use new technologies to strengthen cybersecurity.

- A greater reliance on artificial intelligence can reduce an organization’s cybersecurity labour demand (not directly a focus of this study)

Overall, New Brunswick punches above its weight in important cybersecurity metrics such as the jobs-to-population ratio, workforce development, and training institutions. Despite some challenges, the province is well positioned for continued growth in this field.

ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.