ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.

Scope

This white paper explores potential policy levers in support of a green, inclusive, and digital-based economic post-COVID recovery.

Economic Resiliency in the Face of Adversity provides an overview of the Canadian economy prior to and during the pandemic, and identifies the following key pillars of a sustainable economic future:

- Digital adoption by Canadian small and medium sized enterprises (SMEs)

- Workforce development and preparedness

- Building resilient supply chains and a focus on trade

- Enabling connected health system

- Building cyber resilience

- Supporting a sustainable and carbon-neutral economy

Study Context

COVID-19 has taken a devastating human and economic toll. To date, hardest-hit sectors in Canada include retail, manufacturing, oil and gas, tourism, food, and accommodation. COVID measures such as lockdowns have hobbled the global economy while simultaneously casting the digital economy in the spotlight.

eCommerce, telemedicine, and reliance online services are on the increase. The anticipated large-scale expansion of the digital economy has prompted innovation, but this also raises important questions about the preparedness of Canada’s communication systems, health systems, education institutions, and trade and transportation networks.

A robust, sustainable and eco-friendly economic recovery will require an exceptional policy response.

Pre-COVID Economic Overview

Prior to COVID-19, Canada’s economy exhibited both very positive and challenging dimensions:

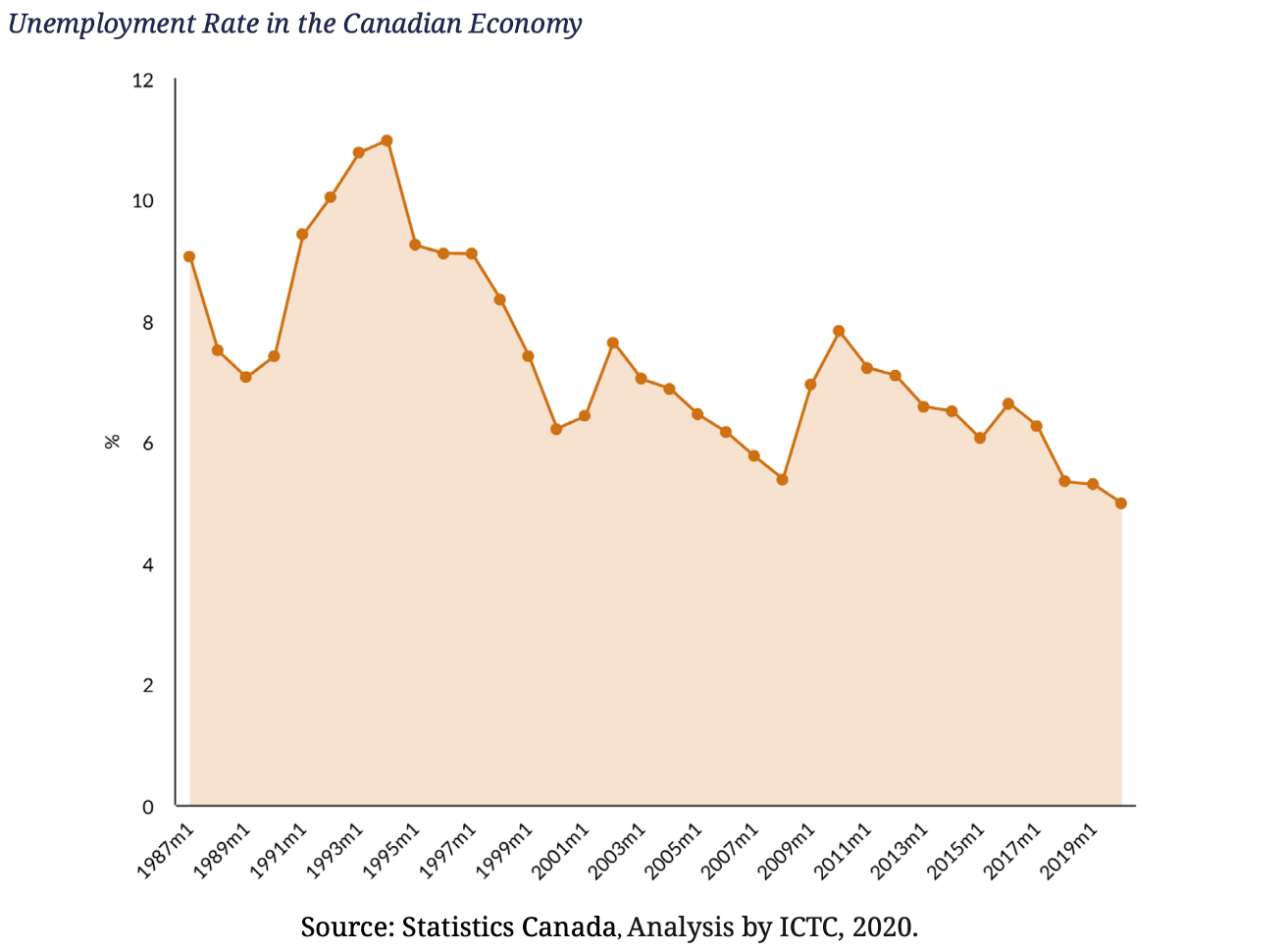

The Positive

- The lowest unemployment rates in decades

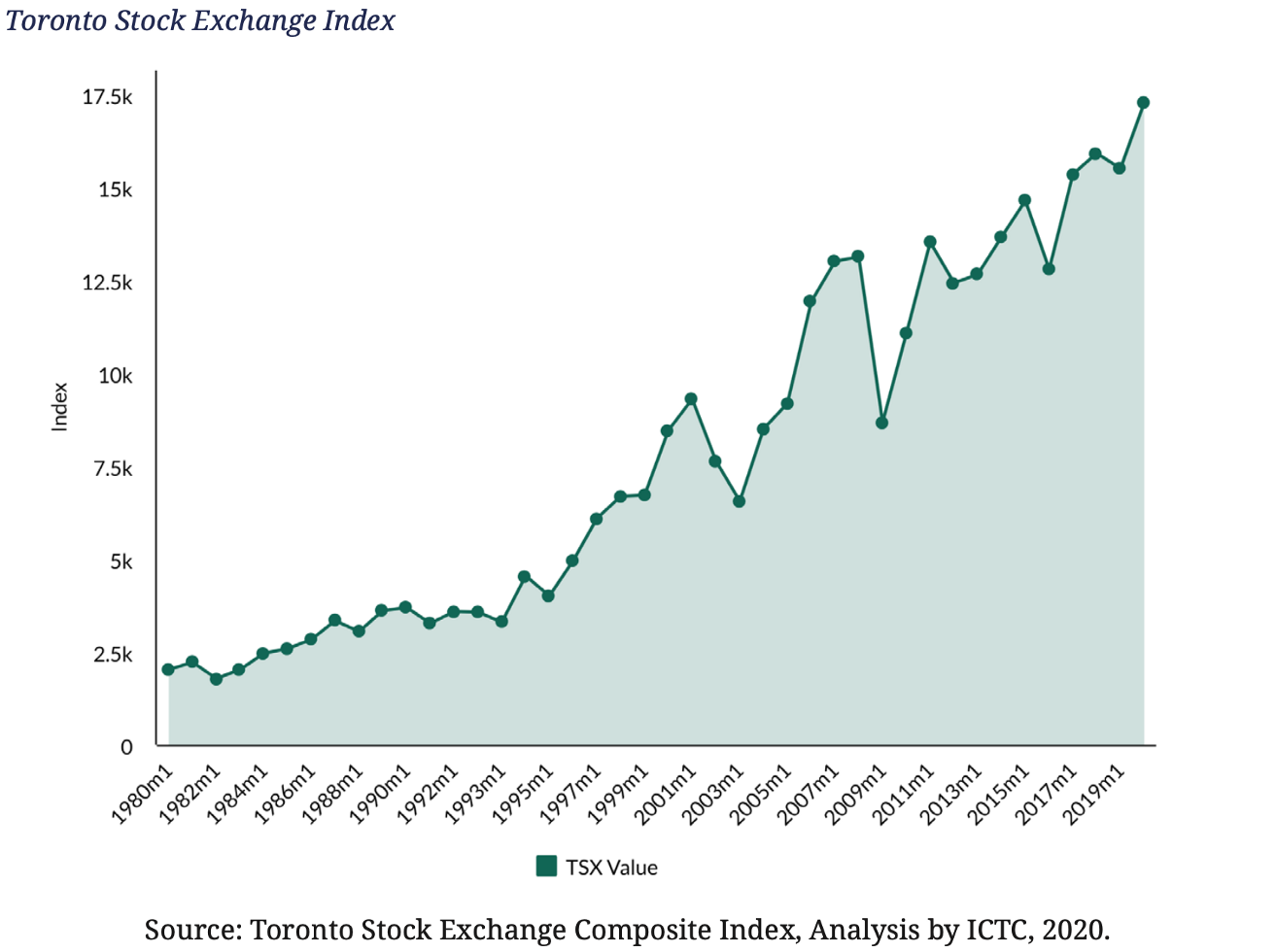

- Market capitalization of publicly traded Canadian firms at an all-time high

- Manageable government deficit and a declining debt-to-GDP ratio

- Low and stable inflation

- Upward long-term trend of trade as a portion of GDP

Note: The S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the TSX with about 250 companies included in it. Last value is January 2020.

Challenges

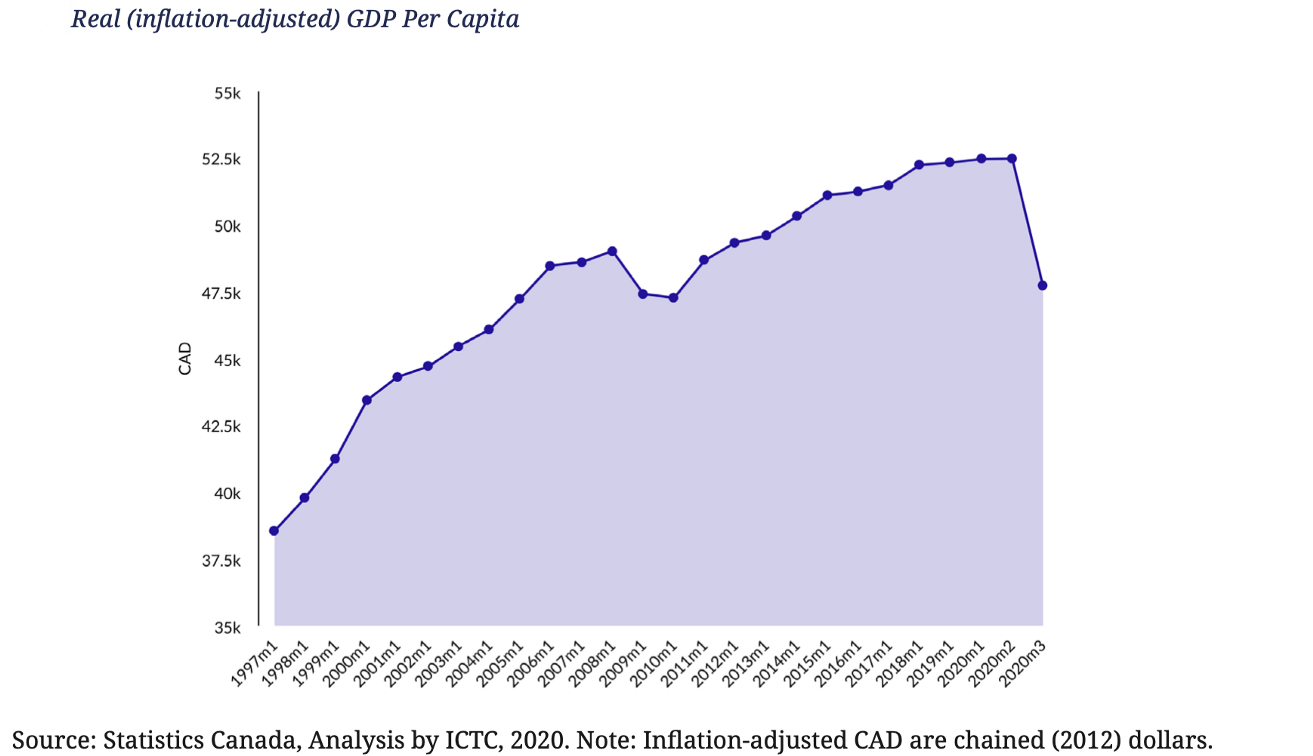

- Lapses in Canada’s economic performance and plateauing real GDP per capita

- Rising income inequality

- Decades of declining labour productivity

- Labour movement from low-productivity to high-productivity regions, amplifying regional disparity

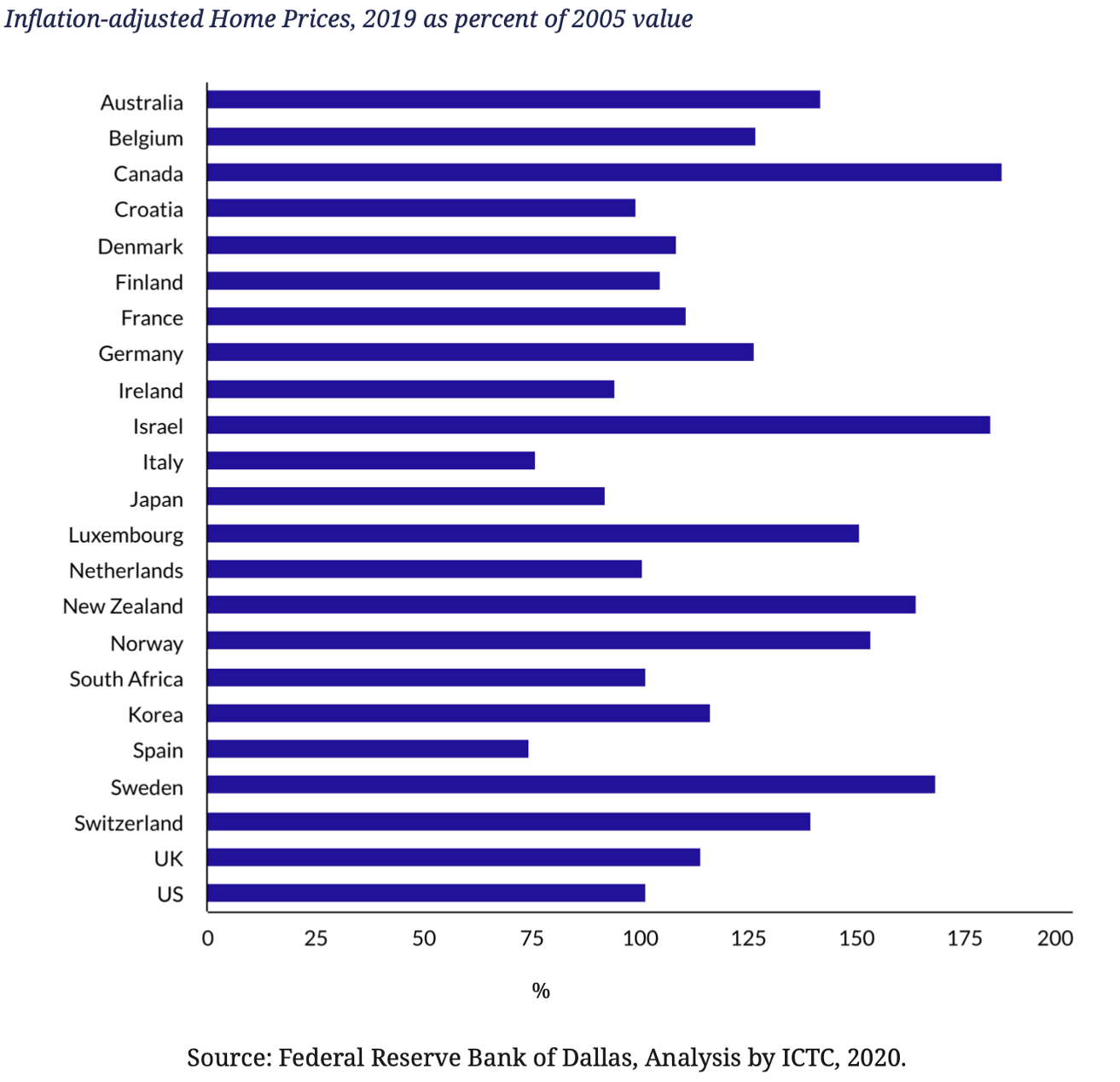

- Some of the highest housing prices in the world

High housing prices pose a formidable risk to the economy. A housing-price “bubble” threatens the stability of the economy when that bubble bursts.

Rising home prices (and rents) increase wealth inequality between the most populous centres and sparsely populated areas, and stalls labour growth.

A resilient economic recovery in Canada will require boosting labour productivity through technology, capital investment, and education.

The Canadian Economy During COVID

As of June 7, 2020, more than 8.4 million Canadians claimed the Canadian Emergency Response Benefit (CERB).

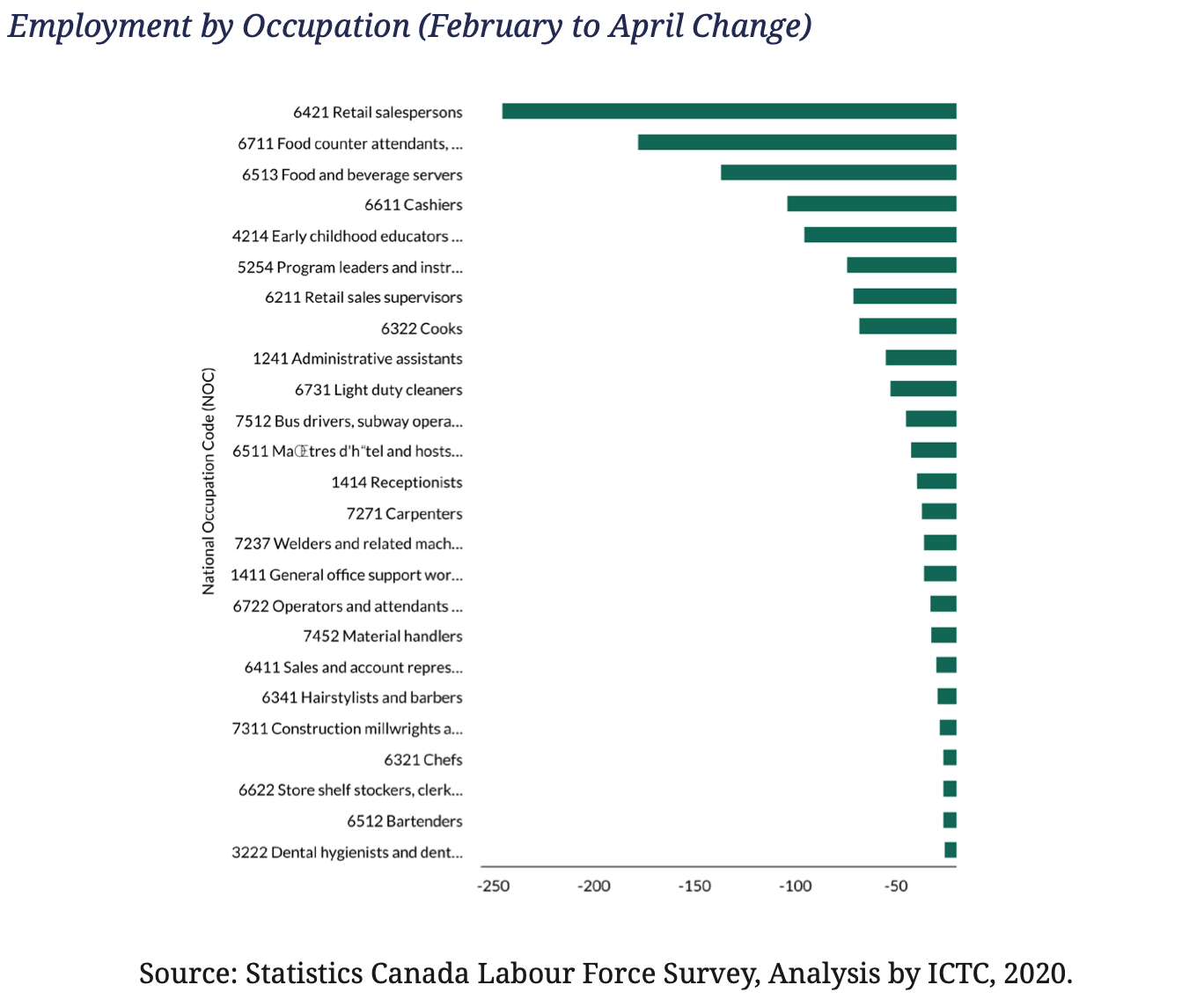

- Approximately 15% (or 3 million) jobs were lost in March/April 2020

- Canada’s employment rate dropped to 41% (employment as a portion of total population) from about 51%)

ICTC research noted that the greatest number of job losses disproportionately impacted the lowest-income occupations.

Anticipated Impacts

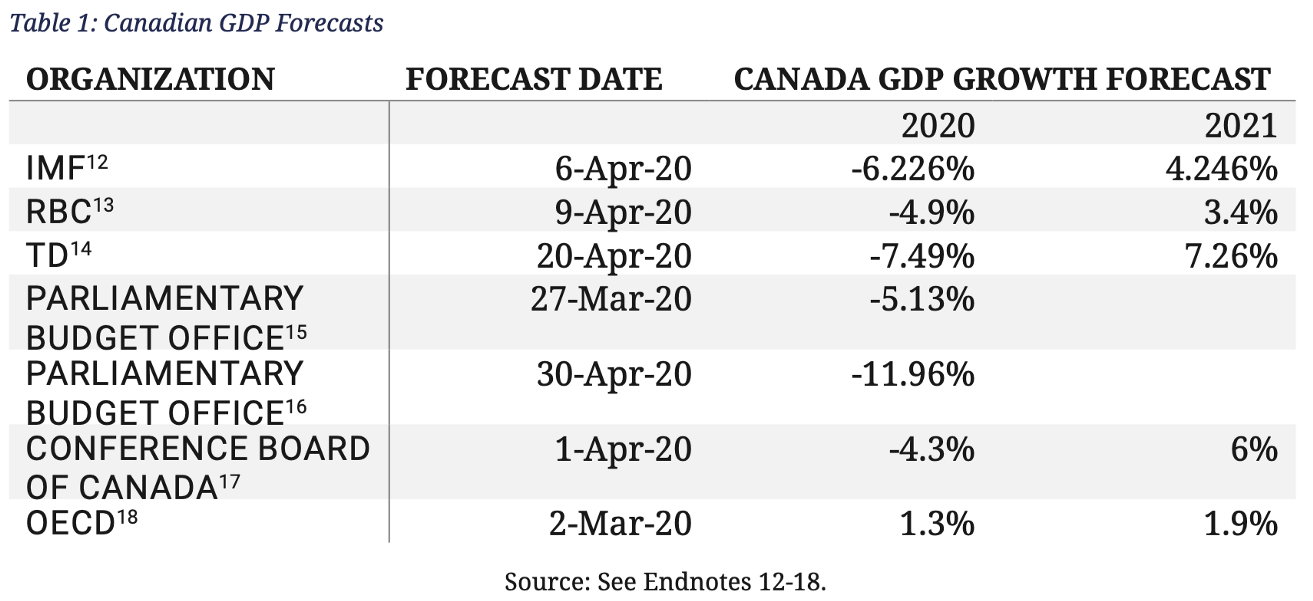

A post-COVID recovery will be shaped by many variables, including the duration of successive waves of contagion, government responses, the arrival of a market-ready vaccine, etc.

Amid the first wave of the pandemic, most forecasts anticipated significant economic contraction in 2020, followed by recovery in 2021.

Grounds for optimism about a post-COVID recovery:

- Relatively stable Canadian TSX Index (after late Q1 2020 bottoming)

- Strong progress toward COVID-19 treatments and a vaccine

- Greater understanding of the virus itself

Photo by Nathalia Segato on Unsplash

Grounds for pessimism about a post-COVID recovery:

- New waves of infection and additional lockdowns

- Flawed understanding of the COVID-19 contagion leading to a longer downturn

- Long-term public spending and economic weakness leading to debt crisis

Pillars of a Resilient Post-COVID Canadian Economy

A resilient post-COVID economy in Canada will require a multifaceted rehabilitation of investment and trade while supporting small business digitization and growth, a responsive healthcare system, and competitive supply chains in which workers have the tools they need to succeed.

I. Supporting Digital-Ready Small Businesses

In 2019, nearly 98% of businesses in Canada were SMEs, employing less than 100 people.

- Only 64% of all Canadian small businesses survive beyond five years, and 44% beyond 10 years

- Survey results indicate that 64% of small businesses face challenges around cash flow

- In 2017, the OECD found that 81% of small and medium-sized businesses in Canada had websites and only 35% of websites had payment capabilities

- Whereas, 88% of British small businesses (89% German and 93% Swedish) had websites, with a significant portion integrating payment platforms

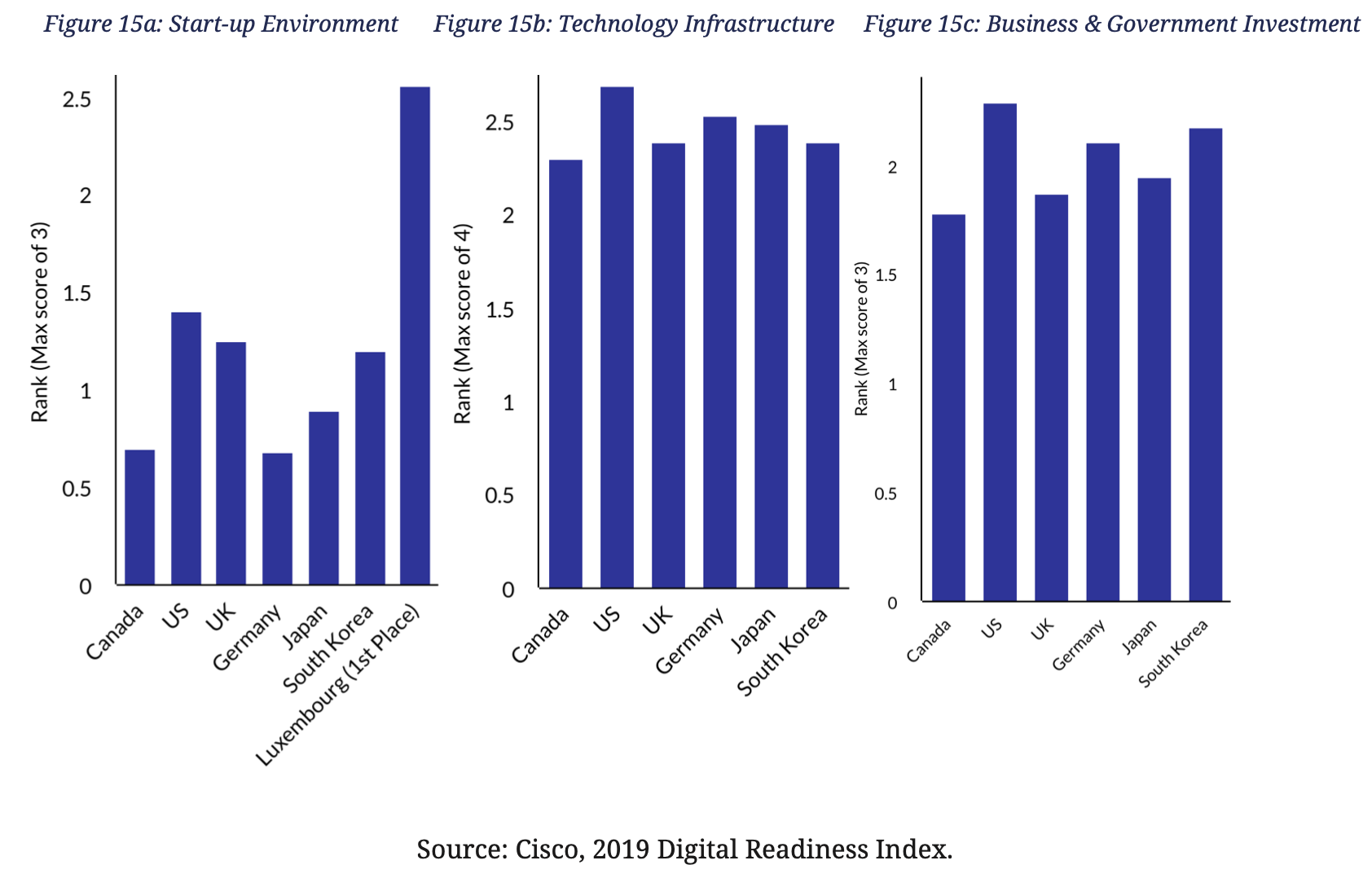

Canada below its peers on metrics such as “start-up environment” (new business density, patents granted/trademarks registered, and venture capital investment and availability), according to Cisco’s 2019 Digital Readiness Index.

ICTC research found that companies in the digital economy are more insulated from the impacts of COVID-19 quarantines and economic slowdown.

What would help SME’s:

- Company investment in cloud technology, fintech applications, accelerated digital adoption

- Tax incentives to spur investment in key digital applications and services

- Grants could help small businesses obtain consulting or advisory services for a digital transformation

- Pairing struggling SMEs with high school “digital natives” could help businesses find solutions to critical digitization challenges, including website creation, social media marketing, online payent set up, etc. (while providing the students with valuable business experience).

II. Digital Adoption, Automation, and the Labour Force

As businesses automate to realize efficiencies, Canada must also ensure access to high-quality fulfilling jobs. A 2016 German study concluded that automation and digital adoption must be paired with proactive policies and include adult and ongoing education to improve labour market impact.

Other jurisdictions can serve as models for balancing the priorities of labour and production efficiency:

- France piloted “Personal Training Accounts” in 2015 — the program extends rights and pathways for upskilling to people, rather than to jobs (funded primarily by employers, an annual cumulative €500 for education that follows an individual throughout their working life)

- Belgium offers an “SME Wallet” — covers 30% to 40% of the costs of training program and includes rights for accessing ongoing education

Canada has a limited government-funded training program, but more extensive support for adults in transition could effect real change.

An impactful ongoing education program in Canada should include the following characteristics:

- Ease of access — reaches the most vulnerable, and is potentially universal rather than application-based

- Shared-cost — funded by individuals, employers, and governments

- Flexibility — would apply to a wide range of approved quality programs but is flexible enough to include timely new offerings in response to market demands

- Broadly recognized — encouraging participation through public awareness campaigns and trusted guidance

Further, Canada could consider providing vocational counselling to adults pursuing upskilling opportunities, comprehensive and affordable skills assessments, and education programs linked to emergency COVID-19 measures.

III. Strengthening Supply Chains in Canada

Securing supply chains in a post-COVID economy must become a key priority.

Developing domestic supply chains is one way to do this, however, “on-shoring” manufacturing from low-cost jurisdictions could dramatically increase manufacturing costs and raise consumer prices.

- Manufacturing labour in China costs roughly $8 per hour

- Manufacturing labour in Canada costs about $27+ per hour

Domestic manufacturing could only become feasible if it is coupled with large-scale automation and digitization of manufacturing plants, potentially leading to “lights out manufacturing” (almost entirely automated).

While high-skilled labour would still be needed to run these factories, labour requirements would not match the levels reached in the 1990s before globalization.

Securing efficient, modern food supply chains will also be essential. Automation will play a key role in.

Canada, the US, and other jurisdictions faced COVID-19 outbreaks in meat-processing plants, causing shut down; however, in Denmark, business carried on as usual.

The Danish Crown’s Horsens facility is one of the world’s largest pig slaughterhouses and is heavily automated. Automated meat production could provide more secure meat supply, reduce waste, and protect the health of workers.

Crop production supply chains stand to become more effective with digitization. Access to near real-time environmental data (precipitation levels, soil quality, humidity, and pest activity, etc.) could help famers make more informed decisions to improve crop quality and yields.

- Attracting foreign direct investment will be critical to digitizing Canada’s food supply chains.

Global trade has proven to increase national wealth, especially for relatively small nations like Canada. But COVID-19 shortages in personal protective equipment and other goods underscores the vulnerabilities that come with trade.

Onshoring certain industries may be of national interest, but it is not feasible or desirable for Canada’s entire economy.

- Free trade agreements, like CUSMA, CETA, and CPTPP will remain key to prosperity in the future.

IV. Enabling a Resilient and Connected Health System

COVID-19 has tested Canada’s healthcare system, but it has also opened the door for restructuring and improvements in healthcare.

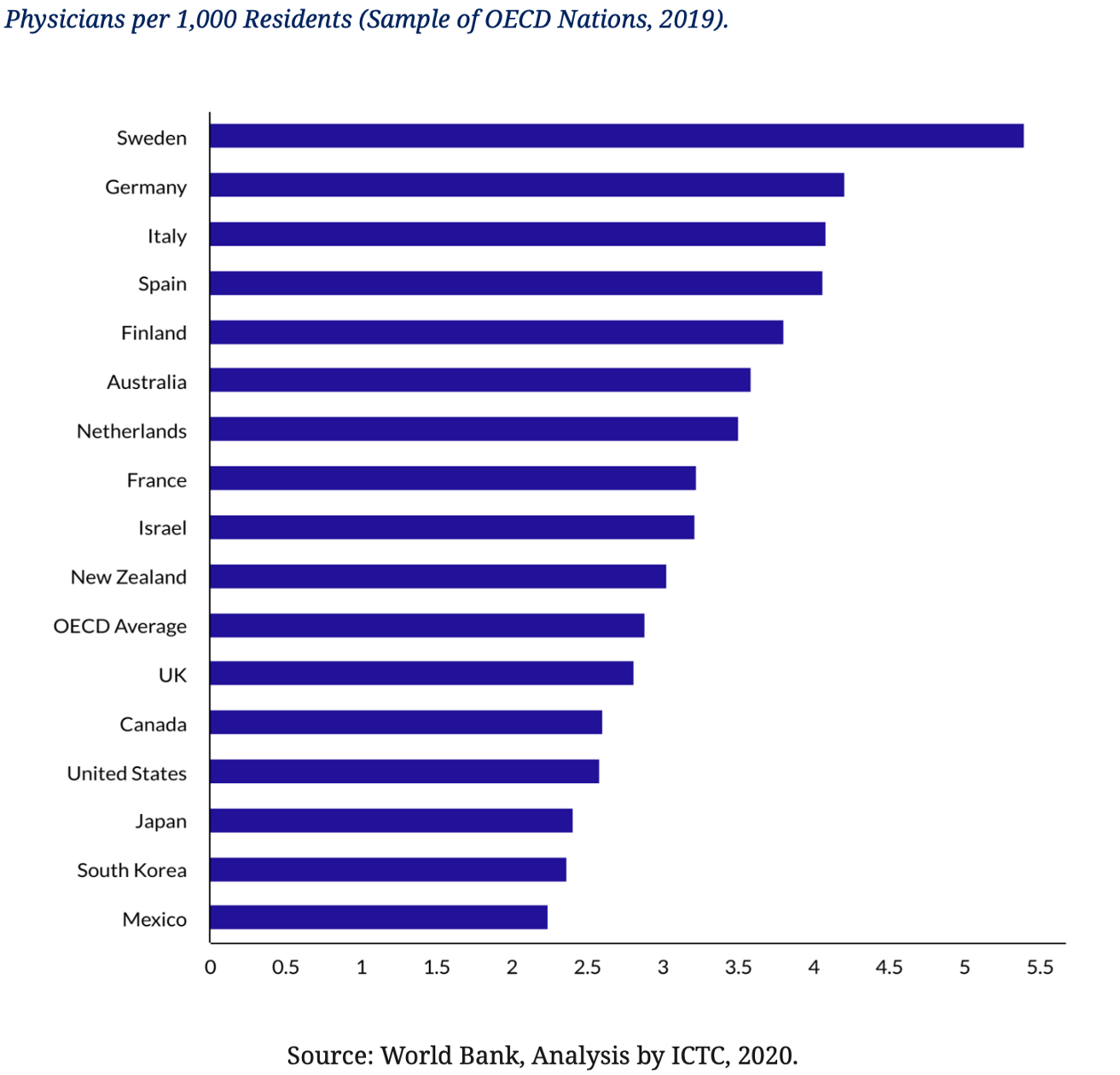

In 2019, the World Bank estimated that Canada had fewer doctors per capita than the OECD average and fewer than other Commonwealth nations:

COVID-19 spurred innovation that previously faced policy hurdles. Canadian doctors can now conduct patient visits by video or phone (widespread use of telemedicine for the first time).

The benefits of telemedicine:

- Protects healthcare worker exposure to infectious diseases

- Prevent viral spread among patients

- Improves access for people with disabilities or those living in remote communities

V. Creating Cyber-Resilient Canadian Businesses

Creating cyber-resilient Canadian businesses is vital.

In 2017, 21% of all Canadian businesses were impacted by a cybersecurity incident.

Canada ranks third globally for data breaches, behind the United States and the United Kingdom. A growing number of attacks focussed on SMEs.

- 40% of Canadian SMEs experienced phishing and virus attacks in 2018

- A third of these were Trojans and spyware attacks

- 27% were ransomware attacks

The pandemic has increased the points of vulnerability for companies, as more people work from home and sometimes lack effective firewalls, strong virus protection or secure Wi-Fi networks.

Securing online operations is mission critical. The following initiatives could assist Canadian SMEs to improve their online operations:

- Tax credits to offset the costs of fending off cyber attacks — the average cost of securing a network solution for a small company is $1,400

- Wage subsidies to help SMEs hire key cybersecurity professionals — key cybersecurity occupations in Canada earned about $96,000 per year

- Cyber hygiene toolkits for SMEs — most cybersecurity incidents are the result of human error, which could be curbed by adopting by best practices for online hygiene

VI. Anchoring a Robust Recovery: Sustainable and Carbon-Neutral Processes

Policy goals should focus on an environmentally friendly economic recovery to weather future crises.

Various international economic policies now consider metrics such as biodiversity loss, air pollution, and average surface temperature.

- Nations are being asked to not roll back existing environmental standards as a part of a recovery

- Stimulus packages should incentivize investment in carbon-neutral processes

- Infrastructure spending should be directed at clean energy production and technologies

- Investments should focus on job creation in conservation, biodiversity, and reforestation

Policies that support private investment in clean energy could help consumers and homeowners to make climate-friendly choices while helping Canada’s cleantech sector scale up and commercialize their products.

Investor tax credits or flow-through shares should be considered.

Policies that secure a sustainable future for transit and mobility may be needed in the wake of COVID-19. Some options include the following:

- Incentivize active or “micro” transport alternatives for active transport options (e.g., bike lanes) and the use smart mobility to support bike and e-bike sharing systems

- Improve the conditions for smart mobility, including connected, autonomous, shared, and electric vehicles.

Investments in active and smart mobility, telecommunications, and EV charging stations would result in transportation alternatives that align with Canada’s environmental goals.

ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.