The Information and Communications Technology Council (ICTC) is pleased to present the ICT Sector Annual Review 2019, a report that explores broad trends over the past year in Canada’s digital economy with respect to economic impact, the labour market, technology adoption, and talent supply.

This 2019 review will be presented through a three-part blog series.

- Part 1: Economic Growth

- Part 2: The Labour Market

- Part 3: Talent Supply

The report utilizes historical data starting from 2009 through to 2019.

To invoke a term from agriculture, 2019 was a “bumper year” for the Canadian ICT sector. Transformed by technologies such as AI and 5G, the sector continued to see strong economic growth and a continuation of industry trends.

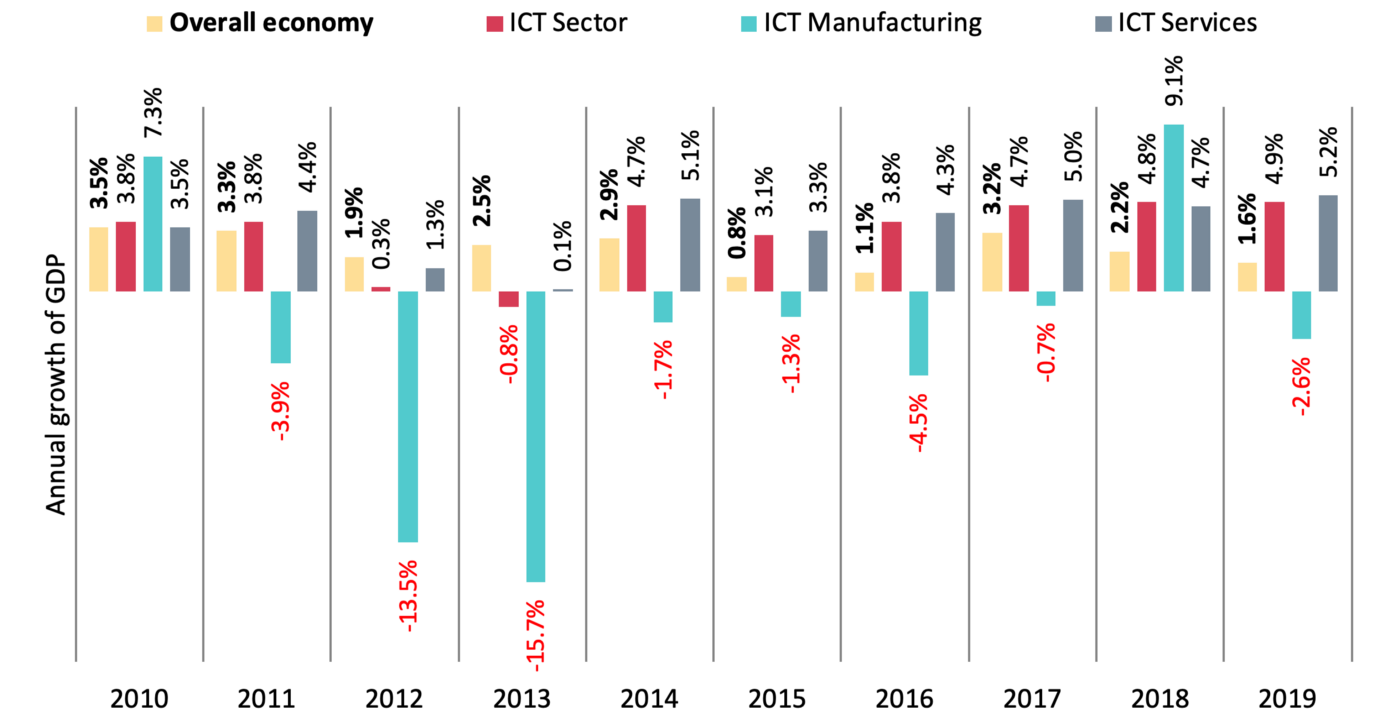

Canada’s tech sector grew to represent historically high Canadian economic output (GDP) of 4.8%. Surpassed only by the fledgling cannabis sector, the ICT sector was the second-fastest growing of 13 major sectors in 2019. The growth of the ICT sector in 2019 was higher than any year since 2009. Tech growth outpaced the growth of the wider Canadian economy (1.6%) by over three times. Within the Canadian ICT sector, the services subsector increased its share, growing by 5.2%, and accounted for 96% of the total sector. In contrast, the ICT manufacturing subsector shrunk by 2.4% and saw its share of the total sector decrease to 4%.

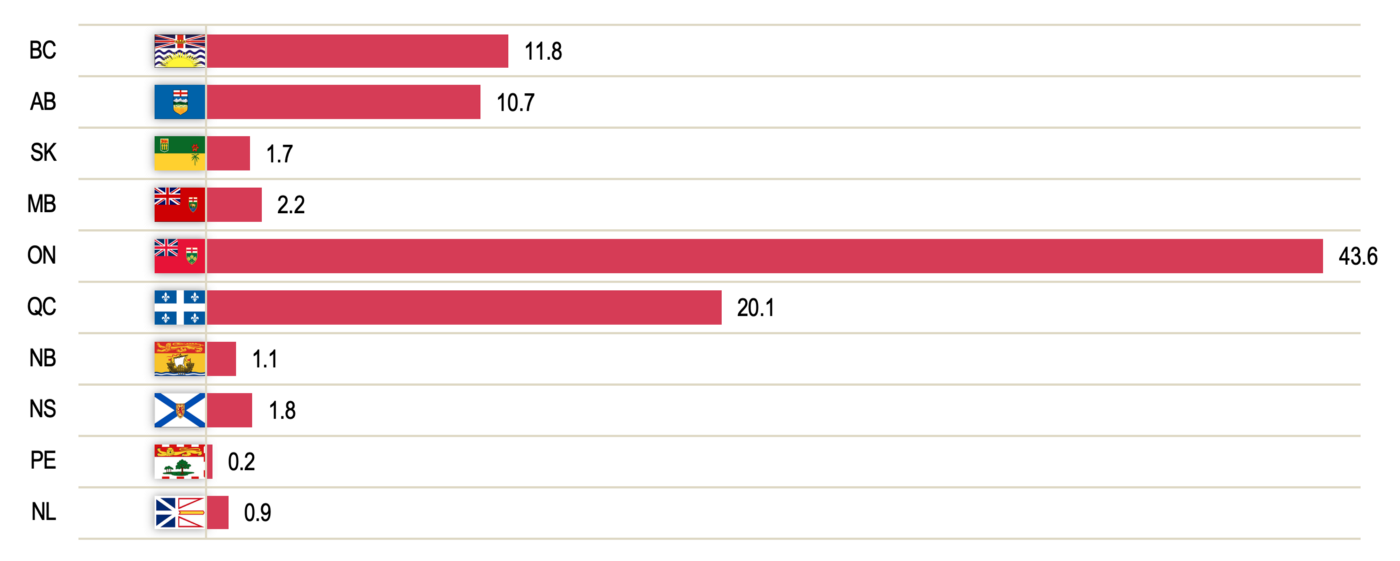

In 2019, Ontario remained by far the largest contributor to Canadian tech, generating more than twice the output of Québec, which was the second-largest contributor. Following Québec, British Columbia and Alberta were the third- and fourth-largest provincial economies for ICT. In total, these four provinces accounted for over 90% of Canada’s ICT output.

ICT’s contribution to GDP continues to rise

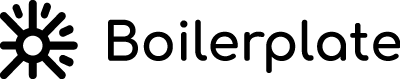

From 2013 onward, the ICT sector has consistently outperformed the overall economy. Real gross domestic product (GDP) produced by Canada’s ICT sector between 2018 and 2019 increased by nearly $4.5 billion, reaching $94.2 billion.

Canada’s ICT sector is a diverse, innovative, and growing segment of the overall economy. Over the last five years, annual growth in Canada’s ICT sector averaged 4.3%, with the latest innovative technologies such as Artificial Intelligence (AI), Big Data, 5G, and blockchain fueling the growth in the sector as well as the overall economy.

Contribution To GDP

In 2019, the ICT sector continued to make a substantial contribution towards Canadian GDP, and over the last five years, the ICT sector’s growth has outpaced the total growth of the Canadian economy. The ICT sector reached $94.2 billion[1] in 2019, accounting for 4.8% of Canada’s total output of over $1,970 billion as of 2019. The ICT sector grew by nearly $4.5 billion (or by 4.9%). The ICT sector’s growth rate was more than triple the rate across the total Canadian economy (1.6%).

Canadian and ICT sector GDP (in billion dollars) - Source: Statistics Canada; Analysis by ICTC.

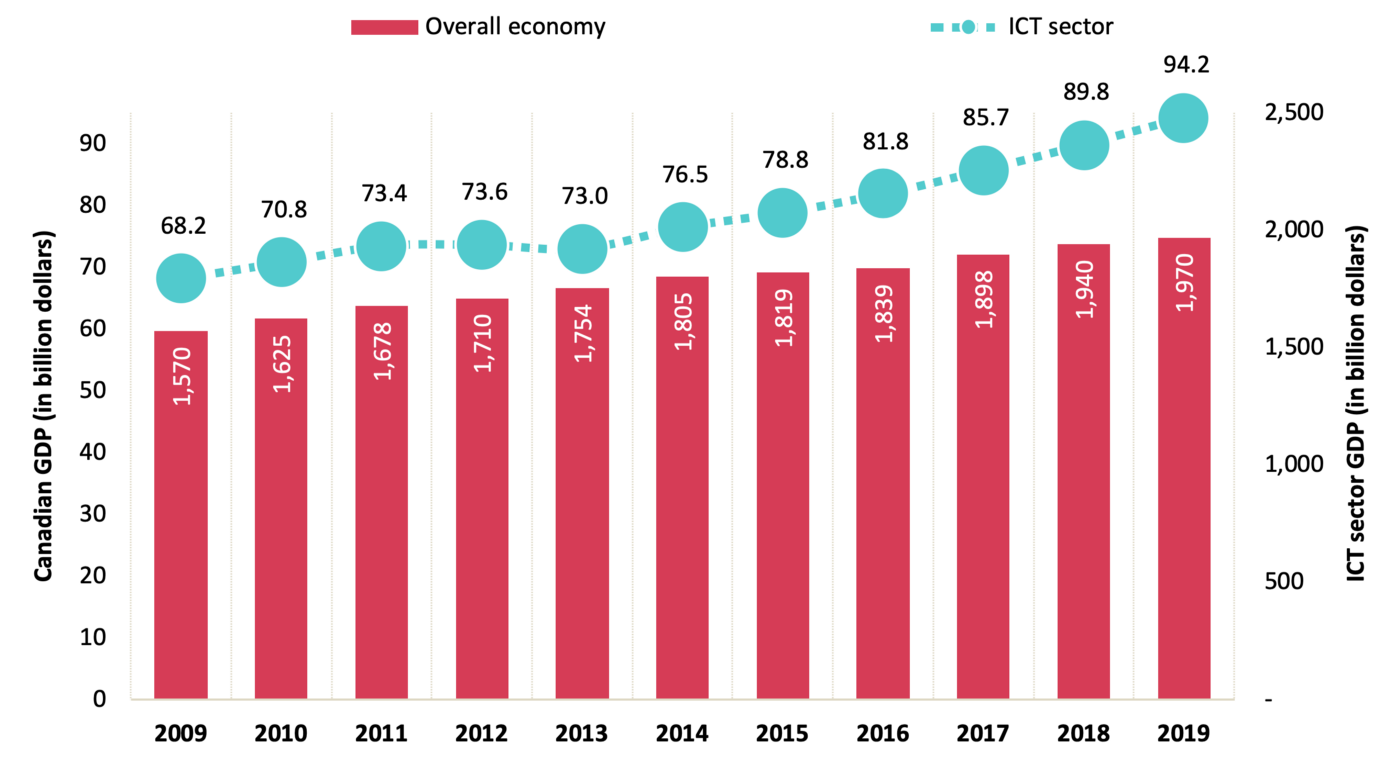

Although the ICT sector as a whole experienced strong growth, the two central ICT sub-sectors (manufacturing and services) experienced different growth trajectories. The ICT services[2] sub-sector — which represents 96% of the total Canadian ICT sector — grew by 5.2% or $4.5 billion. The ICT manufacturing[3] sub-sector — representing the other 4% — shrunk by 2.6%, or $100 million.

Annual growth of GDP - Source: Statistics Canada; Analysis by ICTC.

Average annual growth in Canada’s ICT sector has totaled 4.3% over the last five years; this was supported by substantial growth in the ICT services sub-sector, which experienced an average annual growth of 4.5% over that period. Services linked to emerging technologies such as Artificial Intelligence (AI), Big Data, 5G, and blockchain have been growing at an even more advanced rate, fueling economic growth in Canada’s ICT sector as well as the overall economy. By comparison, the ICT manufacturing sub-sector stagnated over the last five years, experiencing an average annual decline of 0.01%.

Average annual growth by sector/industry, 2019 — Source: Statistics Canada; Analysis by ICTC.

The ICT sector’s growth of 4.9% in 2019 was not as high as that of the rapidly emerging cannabis sector, but ICT far outpaced the growth in all other key sectors of the Canadian economy. Overall, the ICT sector grew at over triple the rate of the total Canadian economy in 2019.

GDP growth by province

The province of Ontario remains Canada’s ICT leader and is estimated to have contributed $43.6 billion to the total Canadian ICT economic output in 2019.[4] Canada’s other key provinces for ICT output were Quebec ($20.1 billion), British Columbia ($11.8 billion), and Alberta ($10.7 billion).

ICT sector output by province (in billion dollars), 2019 — Source: Statistics Canada; Analysis by ICTC.

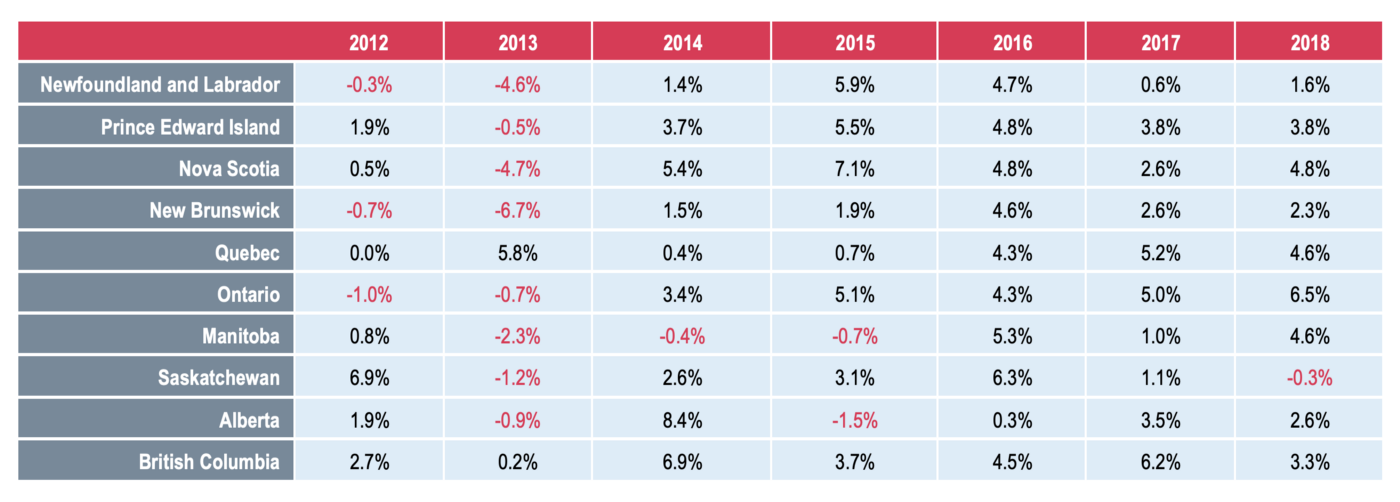

The ICT sector in Ontario (⬆6.5%), Nova Scotia (⬆4.8%), Quebec (⬆4.6%), and Manitoba (⬆4.6%) grew the fastest in 2018, while the ICT sector in Saskatchewan (⬇0.3%) saw a small decline in 2018. Quebec and British Columbia are the only provinces which maintained positive ICT sector growth for all of the last seven years.

ICT sector GDP by province (annual percentage change) — Source: Statistics Canada; Analysis by ICTC.

Canada’s digital economy has a lot to look forward to — in the long term

Greater technology adoption holds tremendous promise for the entire Canadian economy. While the ICT industry is a key pillar of Canada’s economy and has seen substantial growth, its growth is only a small part of the economic impact of technology in Canada; roughly two-thirds of Canada’s ICT employees work outside the ICT sector. Technologies such as AI are being rapidly adopted to deliver value in sectors as diverse as Agriculture, Manufacturing, Retail, Resource Extraction, and Health.

Whether Canada can continue exploiting its digital potential will depend on whether Canadians are equipped with the skills to innovate new technologies and adopt existing ones to create value. Ensuring Canadian workers have the talent to create and use technologies is more critical than ever before. Partnership and communication between industry, government, and the education sector can be leveraged to ensure a smooth pipeline of talent that creates start-ups and satisfied the needs of established employers.

Interested readers are encouraged to review ICTC’s recent research exploring the long-term labour market outlook, talent solutions, and the adoption of digital technology by Canadian enterprises of all sizes. These studies provide insight at the municipal, provincial and federal level. This insight is designed to assist employers, policymakers and educators to optimize their contributions to the digital economy through appropriate policies and training programs.

Recent ICTC insights, studies, and solutions addressing these issues include:

- On The Edge of Tomorrow: Canada’s AI-Augmented Workforce

- Building Canadian Consensus: Our Maturing Blockchain Ecosystem

- Canada’s Growth Currency: Digital Talent Outlook 2023

- Smart City Priority Areas and Labour Market Readiness for Canadians

- A Digital Future for Alberta

- Developing Cyber Talent for Canadian Critical Infrastructure — Road Transportation

- 5G Jumpstarting our Digital Future

- ICTC’s Perspectives on a Data Economy Strategy: Empowering Canada’s 4th Industrial Revolution

[1] In 2012 chained dollars. Chained dollars are real dollar amounts adjusted for inflation.

[2] This combines the North American Industry Classification System (NAICS) codes 4173, 5112, 517, 518, 5415, 8112.

[3] This combines the North American Industry Classification System (NAICS) codes 3341, 3342, 3343, 3344, 3346.

[4] 2019 ICT sector GDP data across province is estimated.